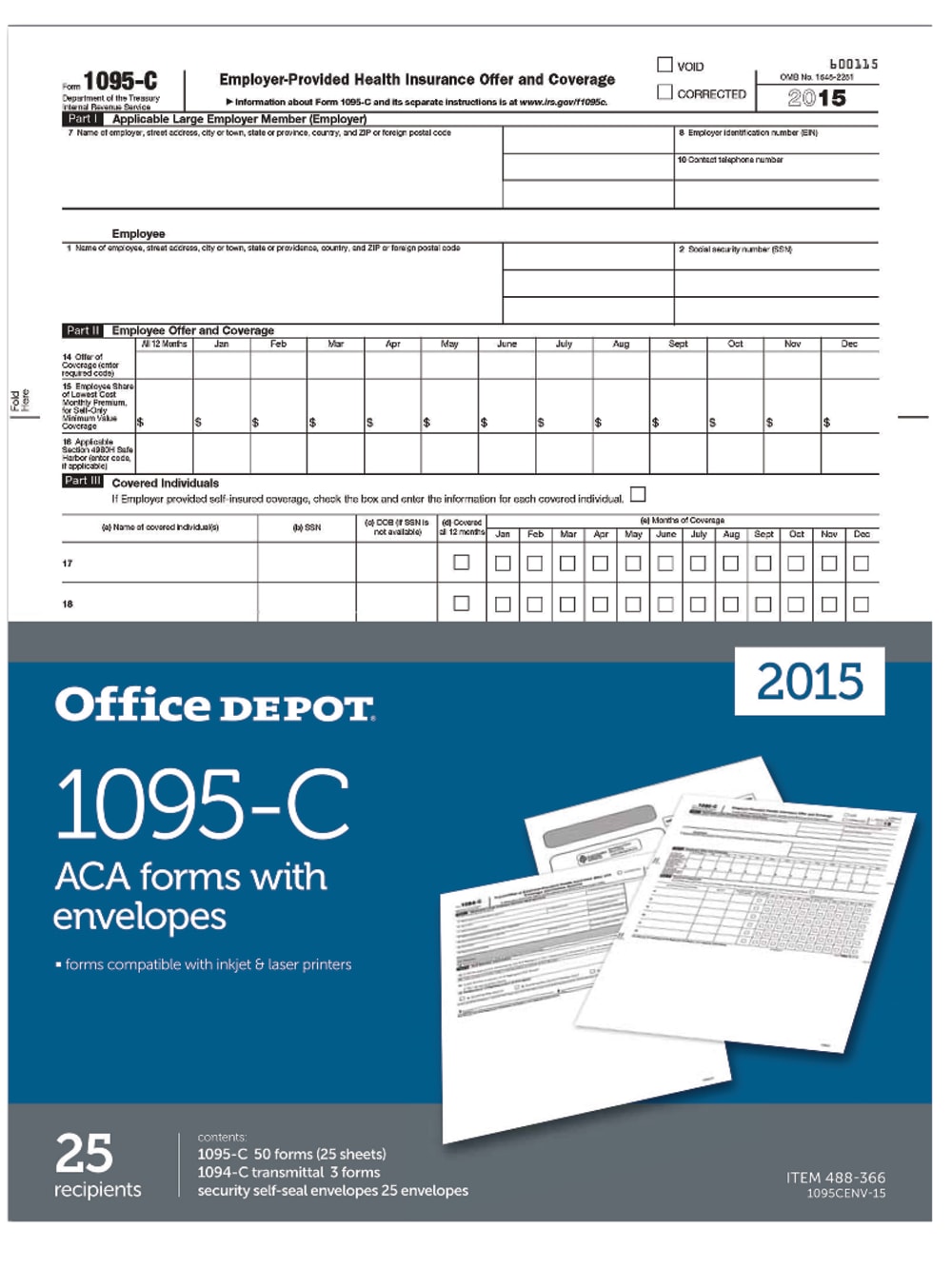

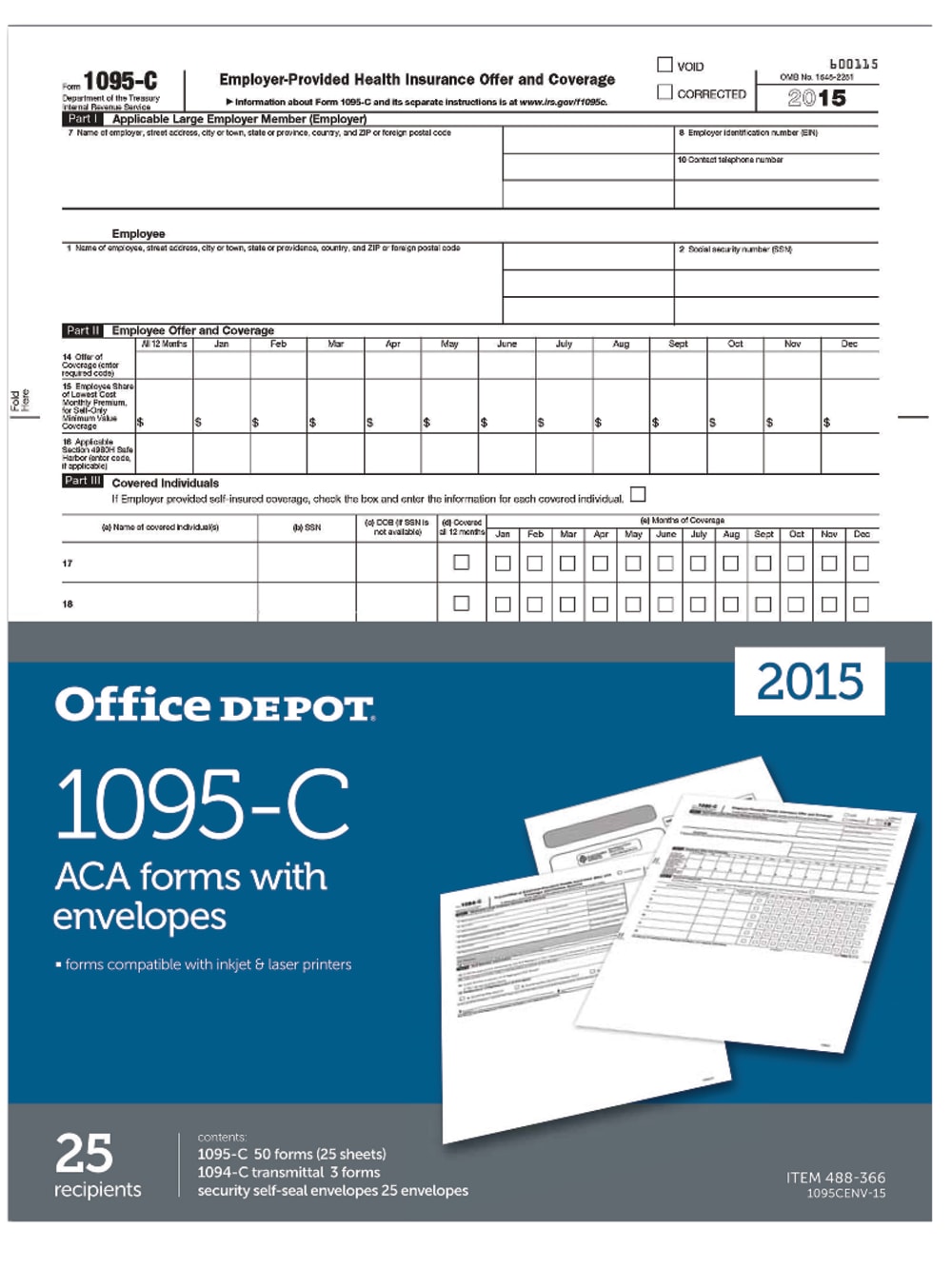

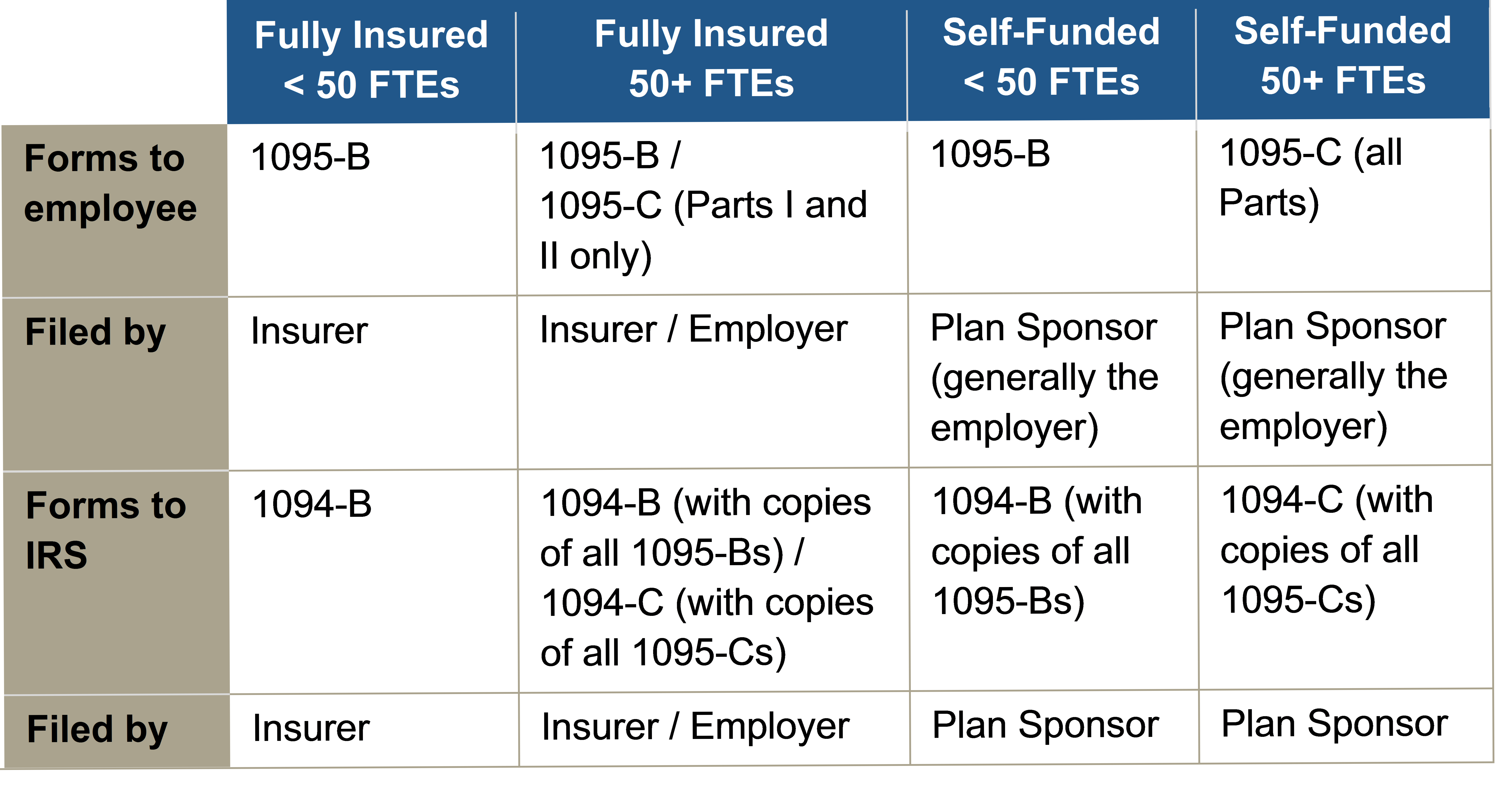

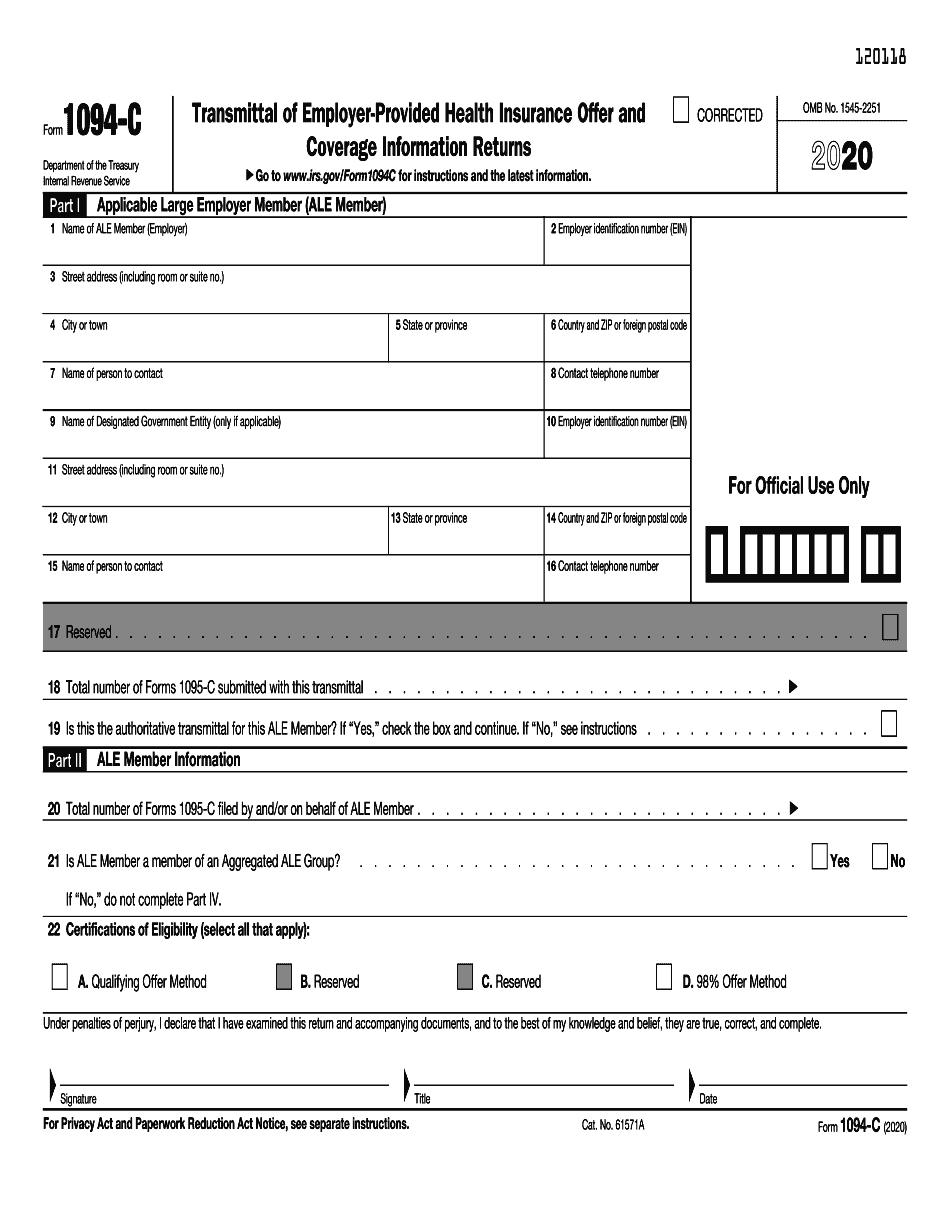

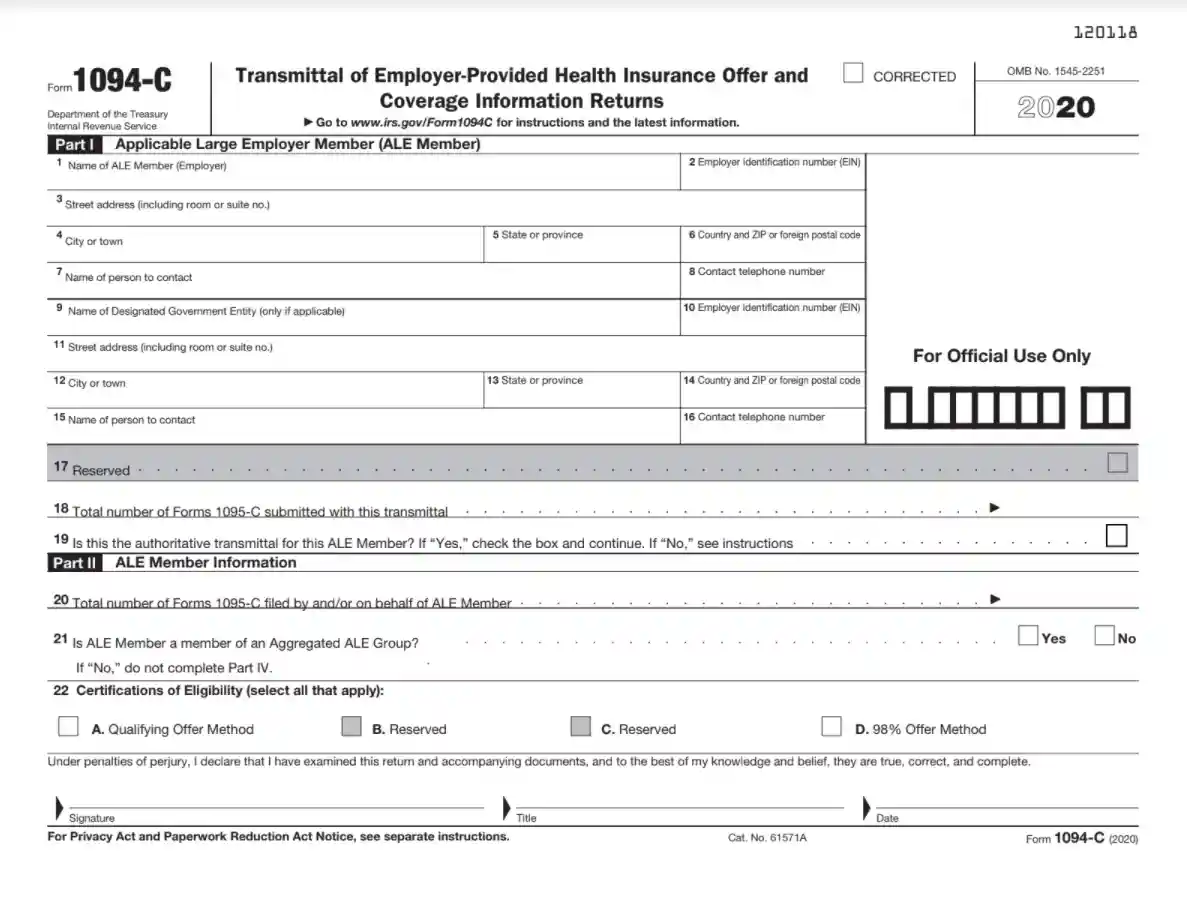

IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the The IRS recently released its draft 1094C and 1095C instructions for the 21 tax year We've identified the changes below It appears that Form 1094C will remain the same, but the instructions do include two new codes for use on Line 14 of the Form 1095C 1T and 1UInst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1094C

2

1094-c instructions 2016

1094-c instructions 2016-Form 1095C Line by Line Instructions Updated on 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updatedInstructions for Forms 1094B and 1095B Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A

Office Depot

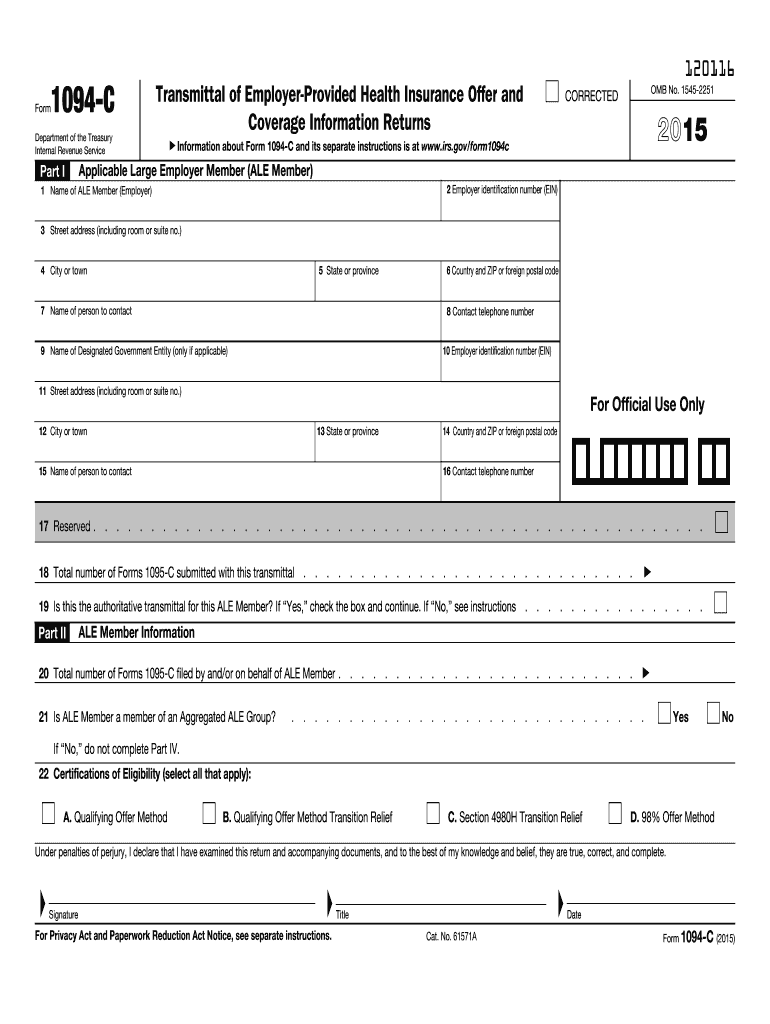

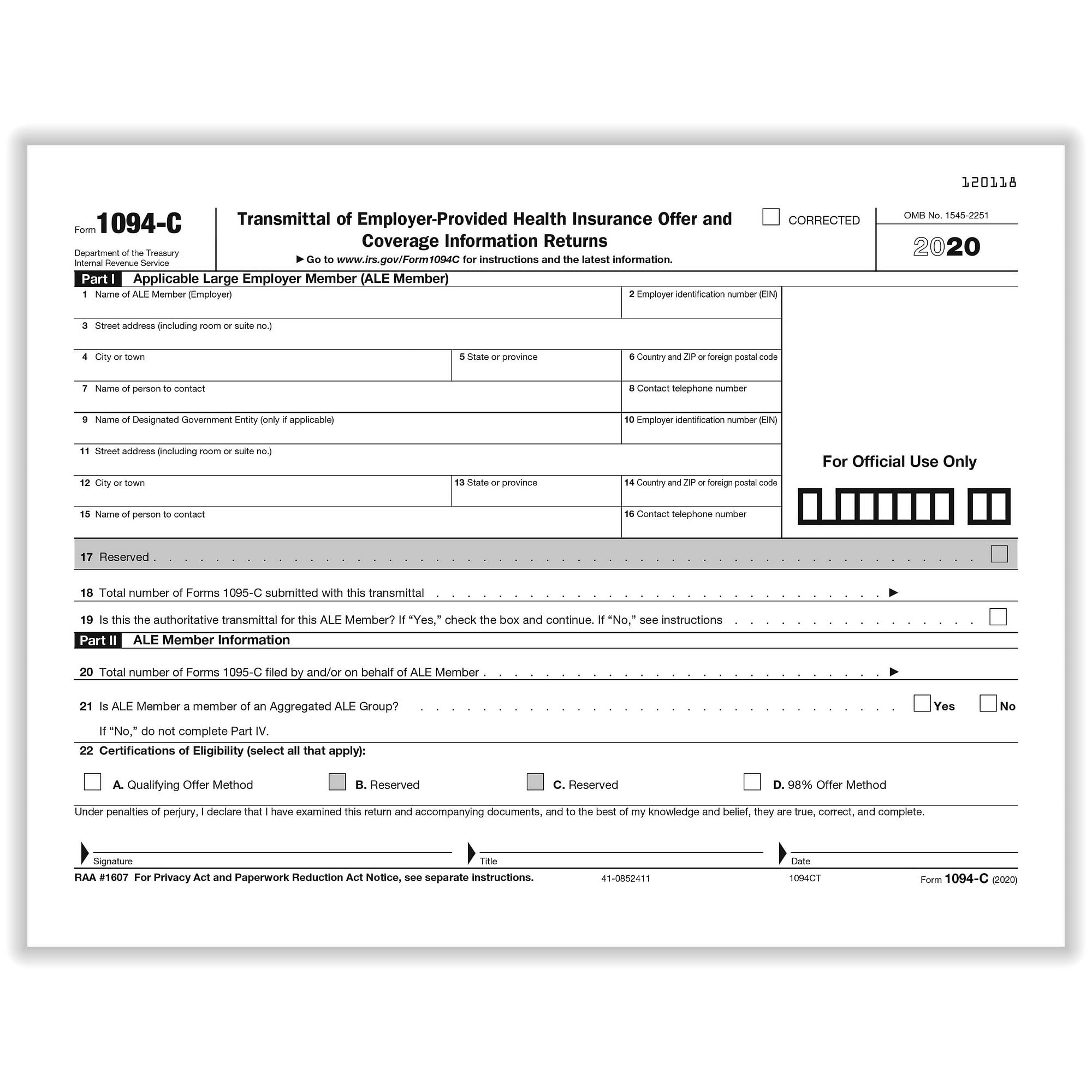

Final instructions for both the 1094B and 1095B and the 1094C and 1095C were released in September 15, as were the final forms for 1094B, 1095B, 1094C, and 1095C Form 1094C Form 1094C is used in combination with Form 1095C• 15 Form 1094 C (transmittal form with copies of Forms 1095C) Due (or , if filing electronically) The due dates are the same as the due dates for Form W2 for the same calendar year If the due date falls on a weekend or legal holiday, the employer may file by the next business day Form 1094C is a coversheet that must accompany every Form 1095C a reporting employer sends to the IRS 36 37 If you find yourself sending a Form 1094C, without attaching Forms 1095C, to the IRS, you are doing it wrong 37 38

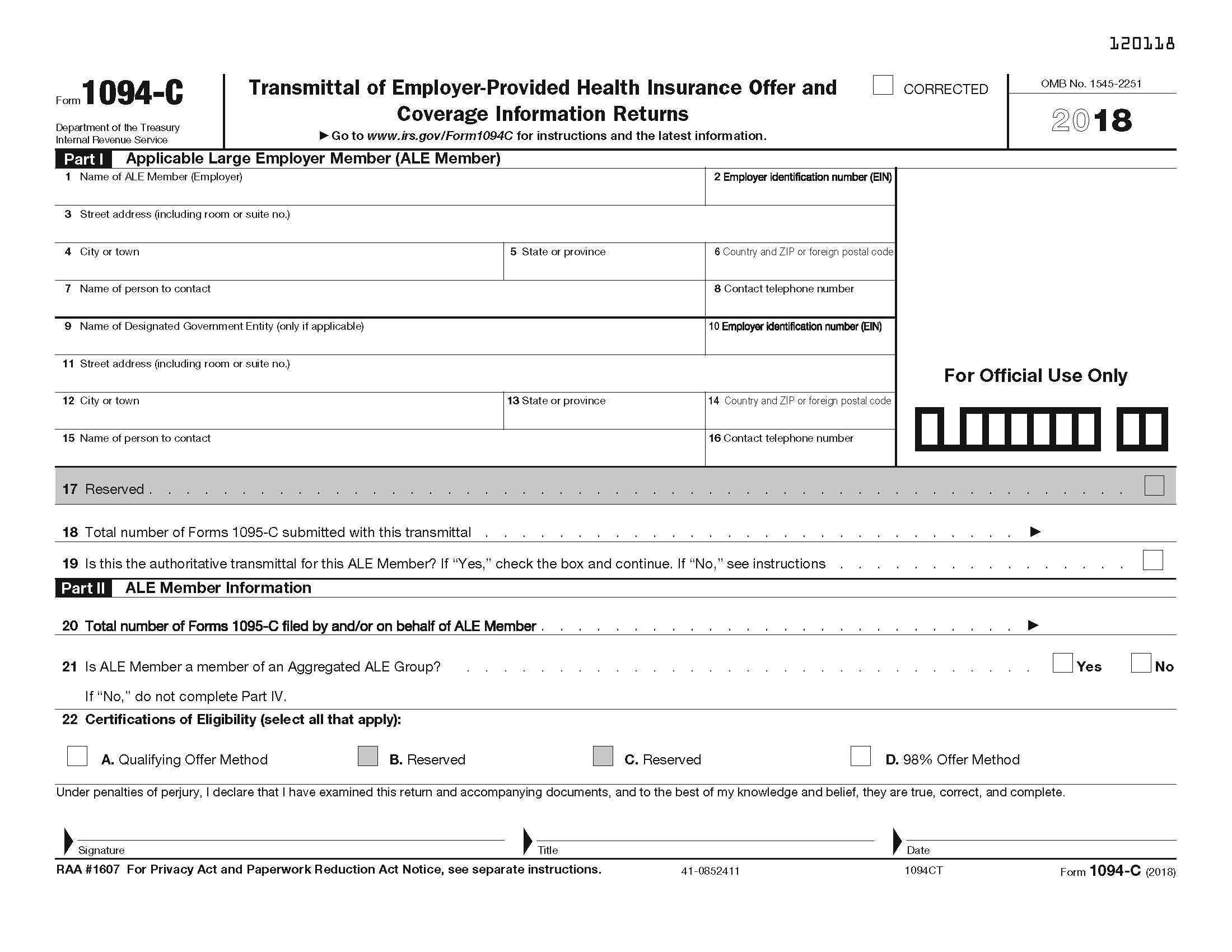

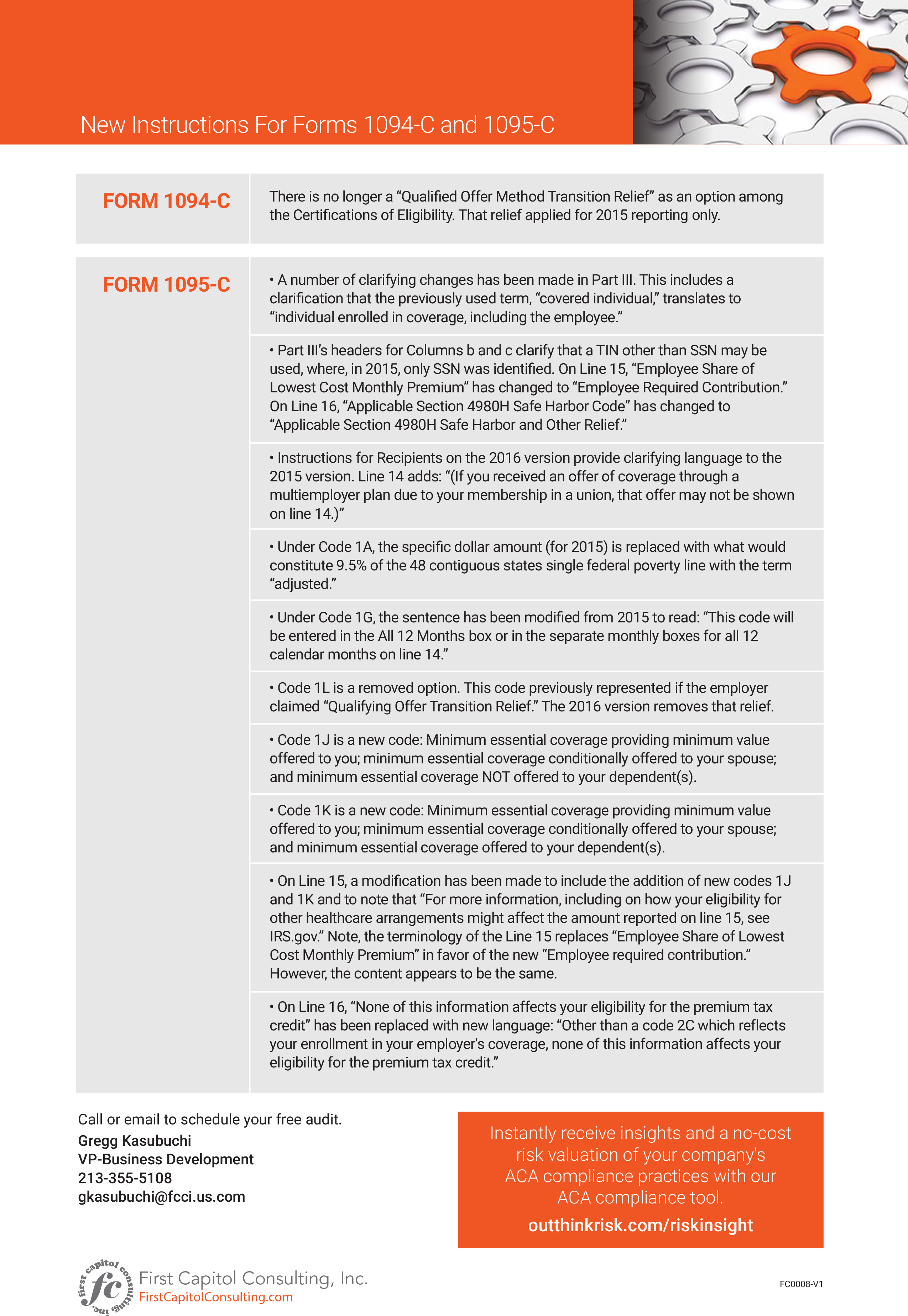

C Form Instructions The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available)For more information, see the instructions for forms 1094C and 1095C Here´s an example of correcting form 1095C In this example, John is an employee of company "X" Company "X´ offered John minimum essential coverage, providing minimum value, and offered at least minimum essential coverage to his spouse and dependents2 Instruction to complete Part II, Employee Offer of Coverage of Form 1095C The IRS has recently made some changes in Form 1095C related to ICHRA plan So, before entering into the lines, employers need to fill the employee's age & plan start month Age If the employee was offered an ICHRA, enter the employee's age on

Instructions for 18 Forms 1094C and 1095C Additionally, the IRS maintains a helpful Information Center webpage with resources and tips for applicable large employers about the information reporting requirements and other topics1094c instructions Complete documents electronically working with PDF or Word format Make them reusable by generating templates, include and fill out fillable fields Approve documents with a legal electronic signature and share them by way of email, fax or print them out Save blanks on your computer or mobile device Increase your productivity with powerful solution?Instructions Tips More Information Enter a term in the Find Box Select a category (column

15 Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Tmlhealthbenefits Org Forms Tml Displaydoc Aspx Doc Id 694 Form Webinar

Visit the Greenshades 1095C & 1094C Print & Mail article for instructions When the 1095C and 1094C documents have been filed through Greenshades, a summary and status of the filings is available when logging into GreenshadesOnlinecom or Downloadmyformcom with your login credentials Greenshades processes the 1095C and 1094CForm 1094C Transmittal of EmployerProvided Health Insurance Offer & Coverage Information Returns Form 1094C is considered as the transmittal Form of Form 1095C and it is used by the employers to report to the IRS Who Needs to File?Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16

Instructions For Forms 1095 C Taxbandits Youtube

2

1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member (defined below) and to transmit Forms 1095C to the IRS The IRS recently updated the instructions of draft 1094C and 1095C for the 21 tax year The modifications and new terms are identified in this article For the tax year 21, the Form 1094C instructions will remain the same, while there is an alteration in instructions for Form 1095C IRS has added two new codes for use on Line 14 of Form1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member and to transmit Forms 1095C to the IRS Form

Www Irs Gov Pub Irs Prior Ib 18 Pdf

2

Form 1094c instructions Complete documents electronically utilizing PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve forms with a lawful digital signature and share them through email, fax or print them out Save documents on your laptop or mobile device Boost your productivity with powerful service? Final instructions for both the 1094B and 1095B and the 1094C and 1095C were released in September 15, as were the final forms for 1094B, 1095B, 1094C, and 1095C Form 1094C Form 1094C is used in combination with Form 1095C to determine employer shared responsibility penaltiesInstructions for Forms 1094B and 1095B Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095C Instructions for Forms 1094C and 1095C

2

Office Depot

Instructions for 1094C Paper filing & Electronic filing The IRS encourages all employers to file electronically if possible However, if any employer must file 250 or more of a single type of form, the employer is required to file electronically This requirement applies separately toInstructions for Forms 1094C and 1095C Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094B and 1095B Instructions for Forms 1094B and 1095B Form 1094BApplicable Large Employers (ALEs), or employers with 50 fulltime employees in the previous year, must file Form 1094C when

Http Www Lockton Com Resource Pageresource Mkt Compliance Oct 15 Aca Reporting Handout Version Pdf

2

Form 1094c instructions 21 Reap the benefits of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web Transform them into templates for multiple use, incorporate fillable fields to collect recipients?Forms 1094C and 1095C are required to be filed by or if filing electronicallyExtensionsYou can get an automatic 30day extension of time to file by completing Form 09, Application for Extension of Time To File Information ReturnsPart II ALE Member Information Line Total number of Forms 1095C filed on behalf of ALE Member In Line , enter the the total number of 1095C Forms that will be filed by the employer This includes 1095C Forms accompanying this Form 1094C, as well as any other 1095C Forms filed with different 1094C Forms under the same employer

Irs Final Aca Compliance Forms Now Available Bernieportal

Http Cbplans Com Wp Content Uploads 19 12 Aca 19 Final Forms 1094 C And 1095 C Issued Pdf

The formatting directions in these instructions (for example, the directions to enter the 9–digit EIN including the dash on line 2 of Form 1094C) are for the preparation of paper returns When filing forms electronically, the formatting set forth in the XML Schemas and Business Rules published on IRSgov must be followed rather than the formatting directions in these instructionsBack to 1094C Form Guide ;1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Form 1094C must be used to report to the IRS summary information for each ALE Member and to transmit Forms 1095C to the IRS Form

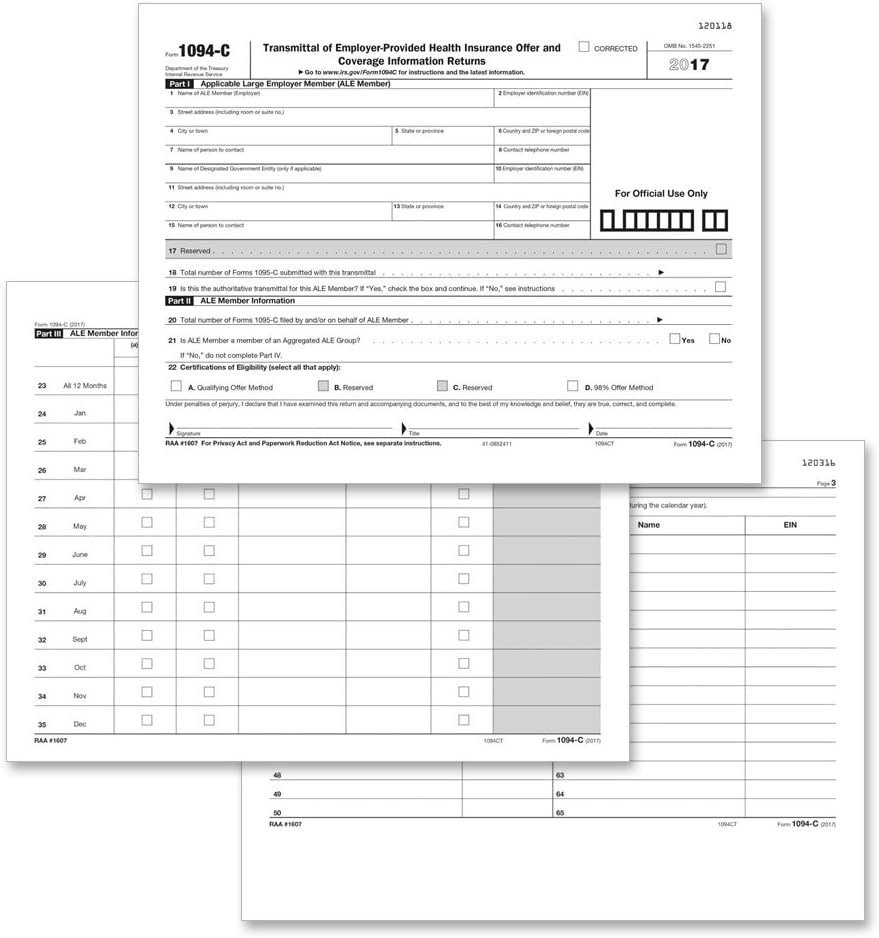

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

2

If an ALE Member recordsdata a couple of Type 1094C, one (and just one) Type 1094C filed by the ALE Member have to be recognized on line 19, Half I, because the Authoritative Transmittal, and, on the Authoritative Transmittal, the ALE Member should report sure mixture information for all fulltime staff and all staff, as relevant, of the ALE Member Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095CAbout Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features Press Copyright Contact us Creators

2

2

If you check Box C, you must also complete Part III, column (e) of Form 1094C, Section 4980H Transition Relief Indicator D 98% Offer Method Check this box if you're eligible for and using the 98% Offer Method In order to check this, you must have offered affordable health coverage to at least 98% of your fulltime employees during theirFile a Form 1094C Transmittal (DO NOT mark the CORRECTED checkbox on the Form 1094C) with corrected Form(s) 1095C Furnish the employee a copy of the corrected Form 1095C, unless the employer is eligible to use the Qualifying Offer Method or Understanding Form 1094C This year companies with over 50 fulltime equivalent employees are on the hook to prove compliance with the ACA's Employer Mandate, or face penalties (even those with 5099 FTEs that aren't subject to penalties this year still need to file) If your company is considered a large employer under

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Some Draft Forms For Aca Reporting Released Resecō

# Publication 35C, California Instructions for Filing Federal Forms 1094C and 1095C Checkbox on Form 540/Form 540NR/Form 540 2EZ for fullyear health care coverage You will check the "Fullyear health care coverage" box if you, your spouse/registered domestic partner (RDP) (if filingData, put and request legallybinding digital signatures Get the job done from any gadget and share docs by email or fax1094C Department of the Treasury Internal Revenue Service Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Go to wwwirsgov/Form1094C for instructions and the latest information OMB No 18 Part I Applicable Large Employer Member (ALE Member) 1 Name of ALE Member (Employer) 2

1

2

In Column (b), enter the number of fulltime employees you had each month, not including any employees in Limited NonAssessment Periods In Column (c), enter the total number of all your employees (fulltime, nonfulltime, and employees in Limited NonAssessment Periods)The IRS has provided instructions on Form 1094C about how fulltime employee status should be calculated Fulltime employee status should be calculated exclusively by using the rules outlined in Code 4980H No other regulations apply when determining fulltime employee status for the Affordable Care Act, even rules that have been constructed1094C, identified on line 19, Part I as the Authoritative Transmittal, must be filed for each employer reporting aggregate employerlevel data for all fulltime employees of the employer

2

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

Mailing Instructions for Filing Paper Forms 1094C and 1095c Here are some general tips for employers who wish to file their Forms 1094C and 1095C by mail Do not paperclip or staple the forms together Check for the correct IRS address Postal regulations require all forms and packages to be sent by FirstClass Mail IRS Releases Final 1094C and 1095C Forms and Instructions On , the Internal Revenue Service (IRS) released the final Forms 1094C and 1095C that are required to comply with section 6055 and 6056 of the Affordable Care Act (ACA) Employers that are subject to the employer shared responsibility provisions under section 4980H Forms 1094C Federal instructions regarding Authoritative Transmittal are not applicable for California purposes Information on federal Form 1094C, line 19, is not required by the FTB When To File You will meet the requirement to file federal Forms 1094C and 1095C if the forms are properly addressed and mailed on or before the

2

Www Cbiz Com Linkclick Aspx Fileticket Tiiy1s9y5pg 3d Portalid 0

The IRS has released the final versions of the ACA reporting Forms 1094C and 1095C, in addition to the reporting instructions for the tax year, to be filed and furnished by Applicable Large Employers (ALEs) in 21 You can find the final filing instructionsUnderstanding Part II and Part III for Form 1094C (16) Part II 22a Qualifying Offer Method To be eligible to use the Qualifying Offer Method for reporting, the employer must certify that it made a Qualifying Offer to one or more of its fulltime employees for all months during the year in which the employee was a fulltime employee for whom an employer shared responsibility payment couldForm 1094C & Instructions Box B The 1094C is the summary of data reported on the 1095Cs for all applicable employees The only significant change is on Line 22, Box B, "Qualifying Offer Method Transition Relief," which was available only for 15 coverage

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

The formatting directions in these instructions (for example, the directions to enter the 9–digit EIN, including the dash on line 2 of Form 1094C) are for the preparation of paper returns When filing forms electronically, the formatting set forth in the XML Schemas and Business Rules published on IRSgov must be followed rather than the formatting directions in these instructions

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

2

2

Irs Release Drafts Of Irs Forms 1094 C And 1095 C The Aca Times

Http Download Paychex Com Pas Pbs Formfiles 1094c Alerts Pdf

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Affordable Care Act Lessons Learned Ppt Download

2

2

2

2

Www Ftb Ca Gov Forms 35c Publication Pdf

2

Www Irs Gov Pub Irs Utl Instructions for ty17 criteria Based aats scenarios Pdf

2

2

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C California Benefit Advisors Johnson Dugan

2

2

2

2

Aca Software Hrdirect

United Benefit Advisors Home News Article

2

2

1094 C 19 21 Online Pdf Template

Http Www Stellarbenefitsgroup Com Wp Content Uploads 15 06 Code Section 6056 What Information Must Be Reported Pdf

2

2

Irs Releases Final 18 Aca Reporting Forms And Instructions Health E Fx

15 Forms 1094 B 1095 B 1094 C And 1095 C Benefits Work

Http Www Unitedactuarial Com Research Pdf 15 09 Pdf

1095 C Form 21 Irs Forms

2

Irs Releases Draft 19 Aca Reporting Forms And Instructions Alera Group

2

Irs Form 1094 C Fill Out Printable Pdf Forms Online

Datatech S Hrm Software Reportes Del Pdf Free Download

Aca State Individual Mandates Etc

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Www Bluechoicesc Com Sites Default Files Documents Agents Coco Aca agent flyers Aca reporting requirements flier Pdf

Q Tbn And9gcsj2fd0y5g6r8mt9bhze7eiq3dikiuy6ur5pdhj7m9zdqnm8y O Usqp Cau

Www Fairviewinsurance Com Index Htm Files Irs releases additional section 6056 codes for ichras Pdf

Www Hayscompanies Com Wp Content Uploads 18 10 Here Come The 1095s Pdf

Forma 1095 C Salud Cobertura Y Sobres Incluye 3 1094 B Transmittal Formas Pack De 150 Formas Amazon Com Mx Oficina Y Papeleraa

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

2

Irs Issues Aca 18 Forms 1094 C And 1095 C Instructions And 226j For 16 The Aca Times

Form 1094 C Instructions For Employers What You Need To Know

2

Updated Irs Reporting Requirements Babb Insurance

2

U S Affordable Care Act Aca Information Reporting 16 Sap Blogs

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

2

2

2

1094 C Transmittal Of Employer Provided Health Insurance Forms Fulfillment

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Www Irs Gov Pub Irs Pdf F1095c Pdf

17 Irs Reporting Requirements Babb Insurance

2

Www Irs Gov Pub Irs Prior Ic 17 Pdf

2

2

Understanding Aca Health Coverage Information Returns Air Reporting

2

2

Help Zenefits Com Documents 446 Aca Form Gen Guide 1 Pdf

2

Blog Irs 1094

Http Www Psfinc Com Hcr Files Agwebinarseries 10 26 17 Pdf

2

New Instructions For Forms 1094 C And 1095 C An Infographic The Aca Times

0 件のコメント:

コメントを投稿