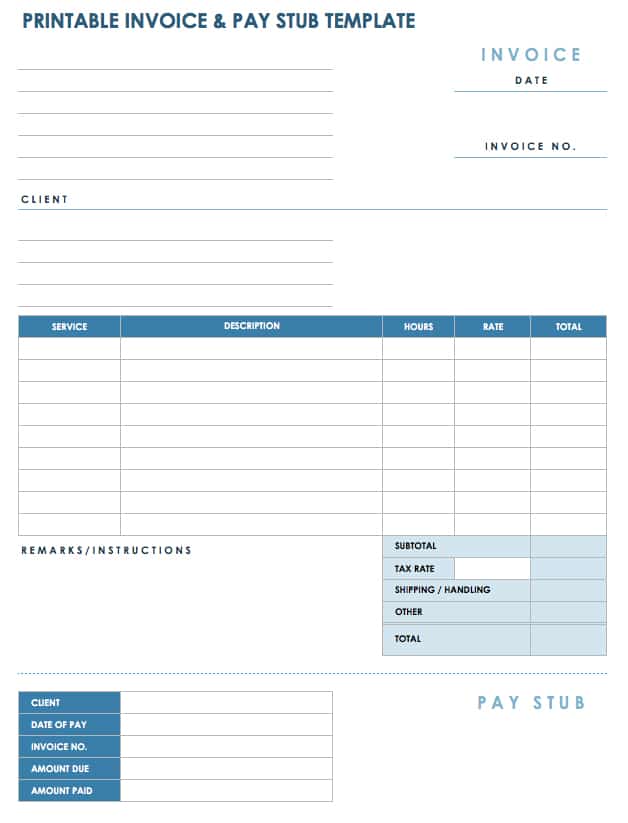

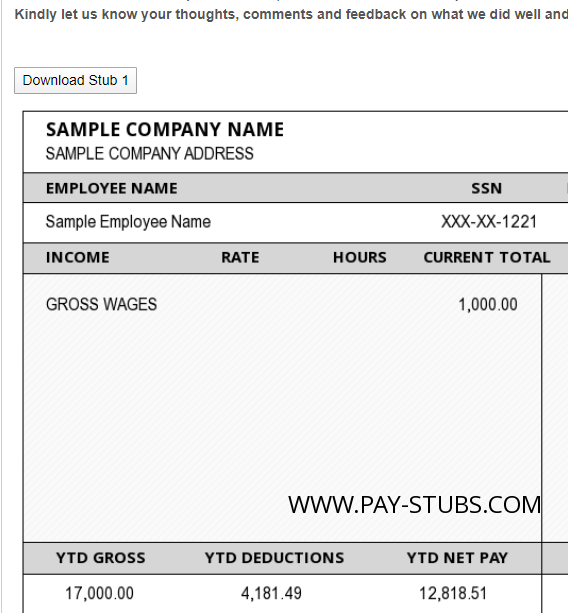

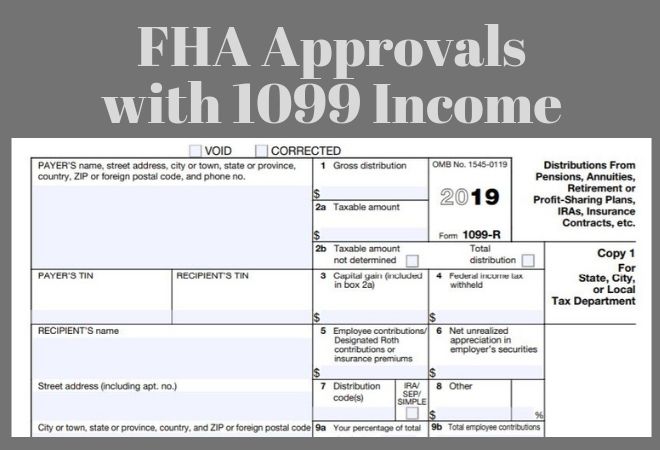

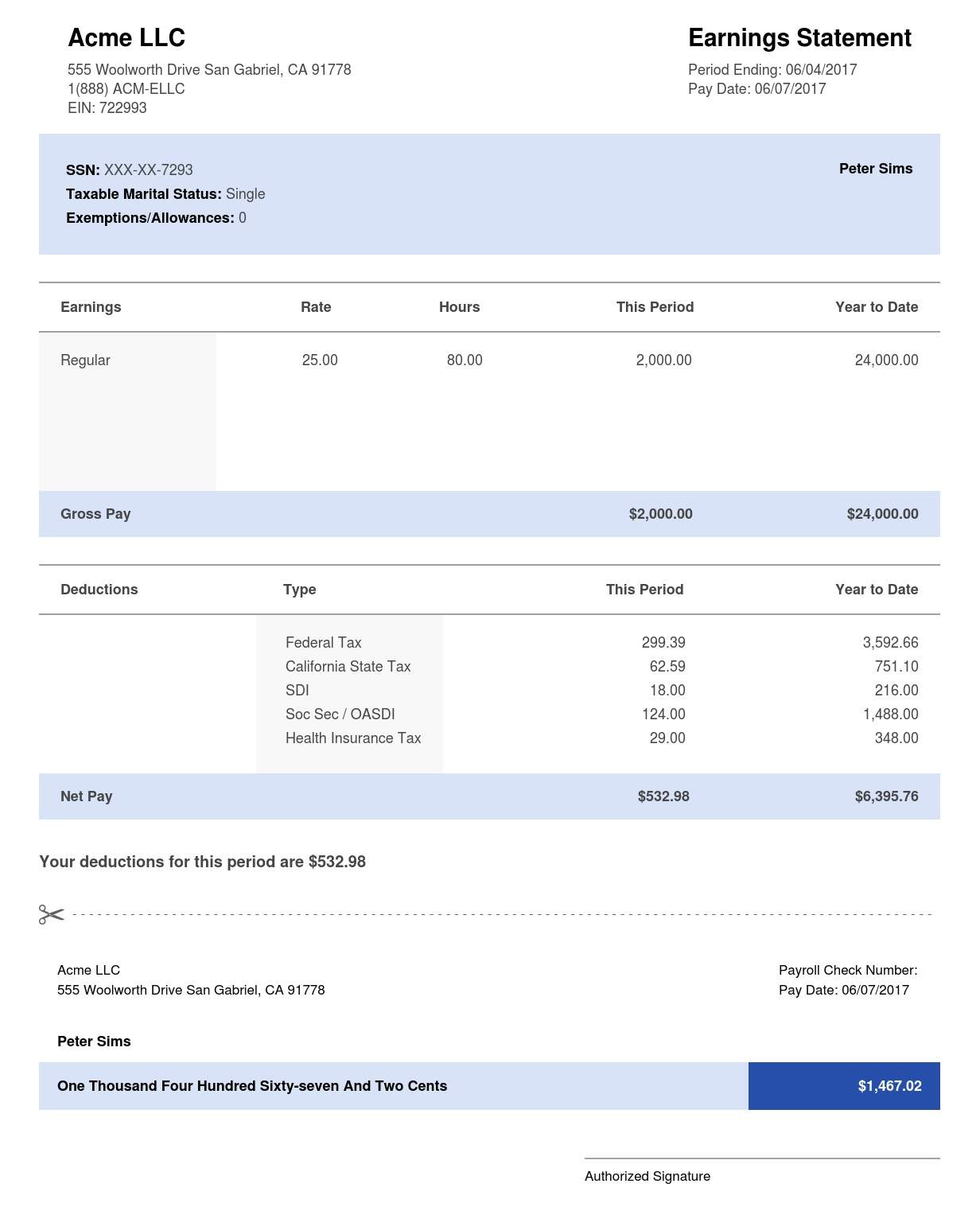

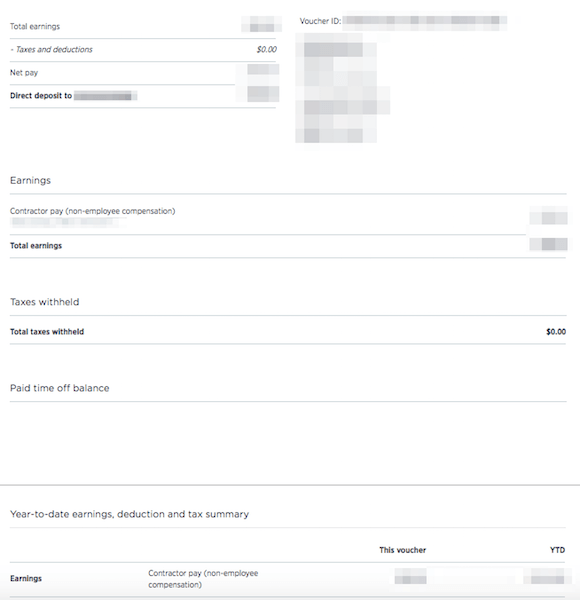

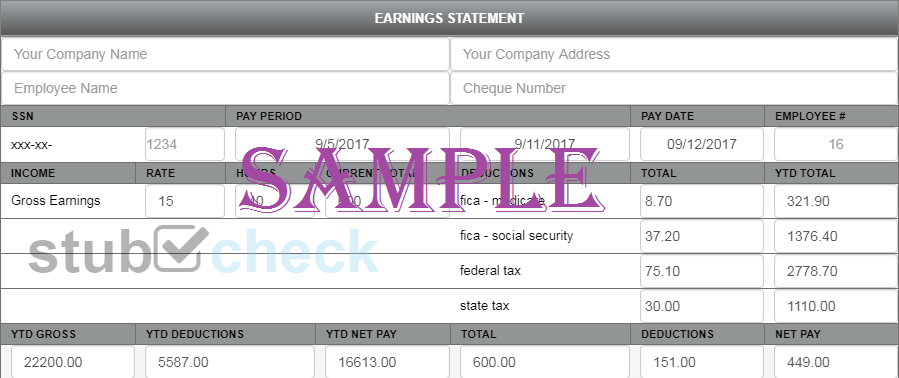

You can find pay stub templates online and create your own Just ensure that you do your research and you're withholding the proper amount for taxes and other deductions The last thing you want to do is to produce a pay stub that is not accurate, after all Creating aSection 409A deferrals $ 14 Nonqualified deferred compensation $ This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported 15 The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary parties

Free Pay Stub Templates Smartsheet

Do 1099 employees receive pay stubs

Do 1099 employees receive pay stubs- 21 Posts Related to Free Pay Stub Template For 1099 Employee 1099 Employee 1099 Pay Stub Template Pdf Pay Stub Template For 1099 Employee The payer should send you a copy of your 1099 by January 31st Keep in mind that if your total payments for the prior year are under $600, the IRS threshold, they may not need to send you a 1099 Regardless of whether or not you receive a 1099 from someone, you are required to report all of your taxable income on your tax return

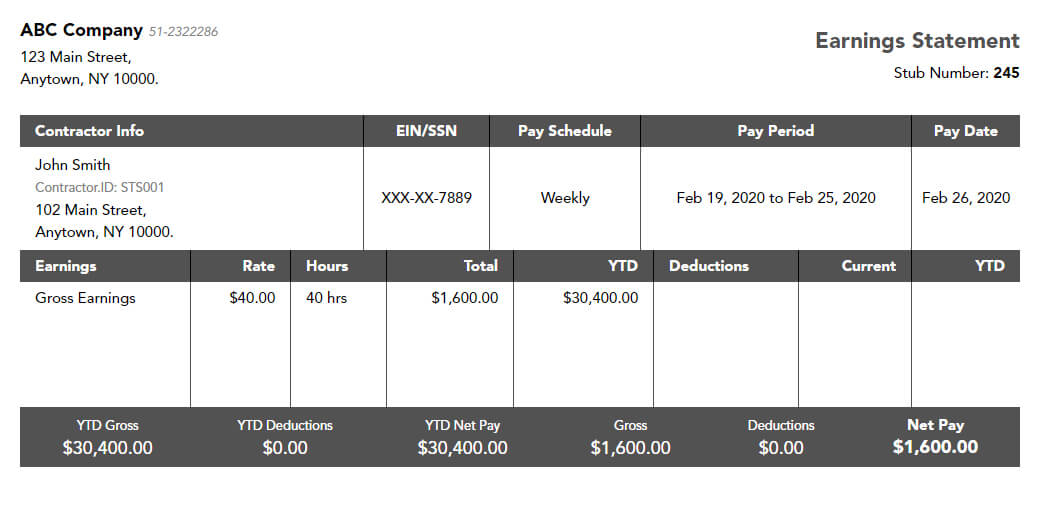

Independent Contractor Paystub 1099 Pay Stub For Contractors

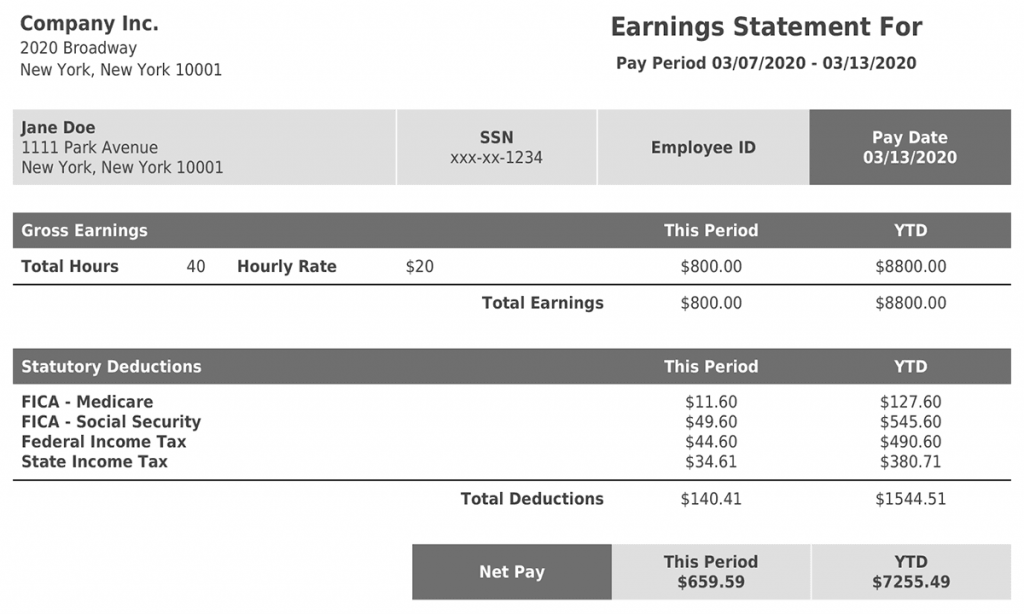

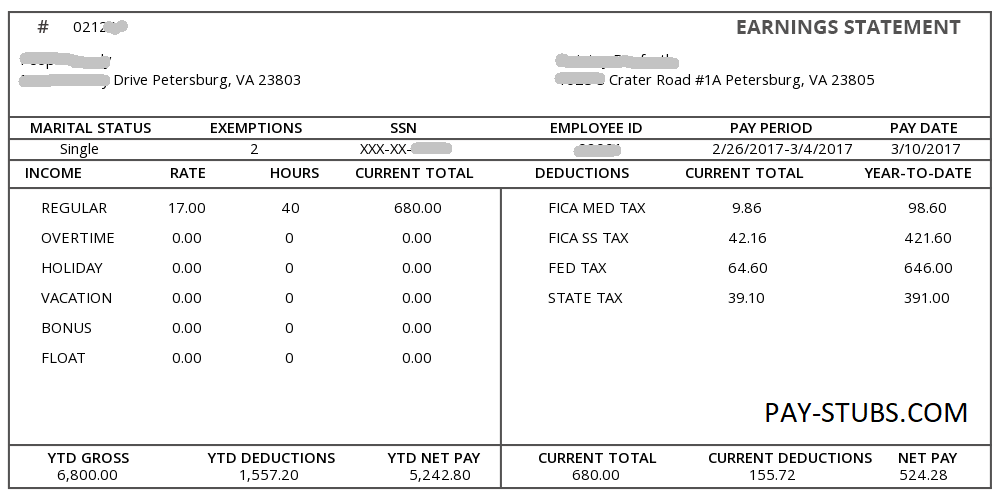

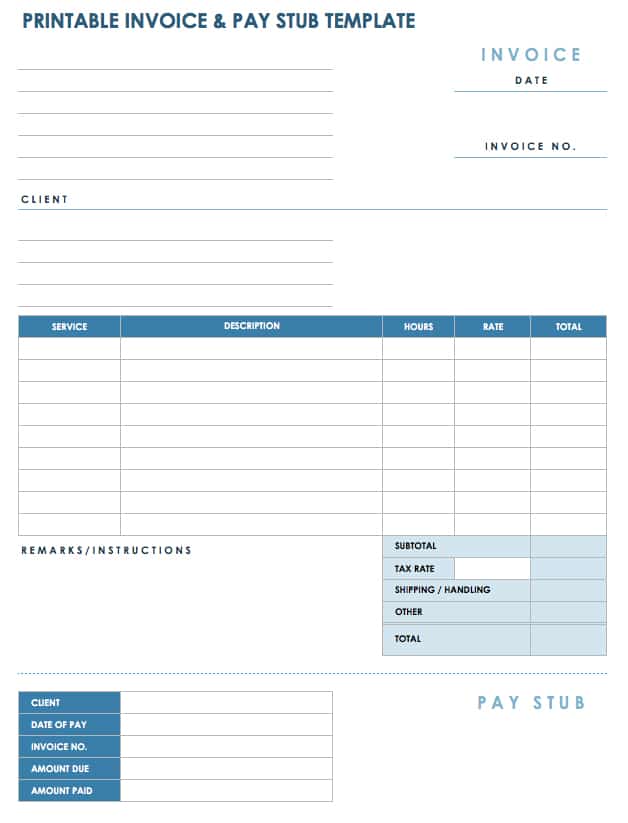

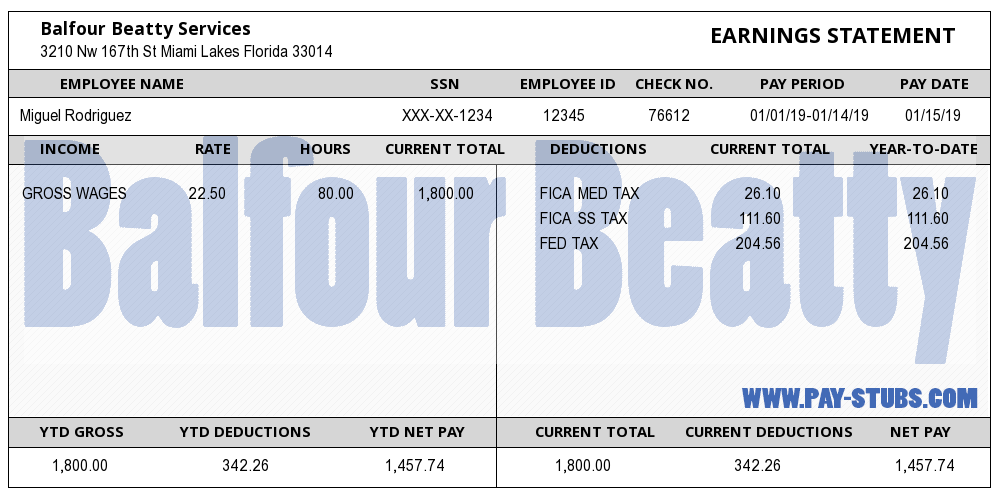

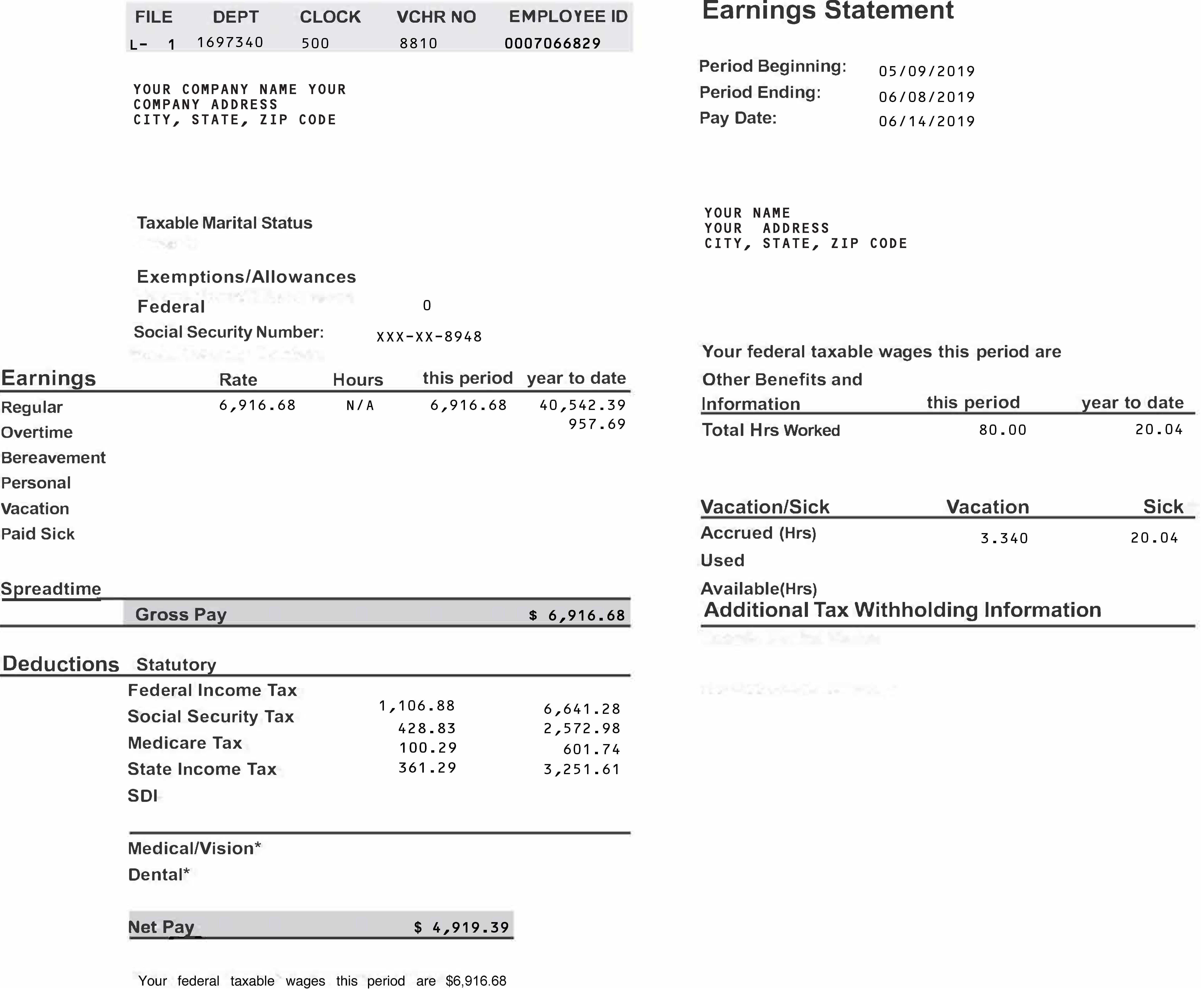

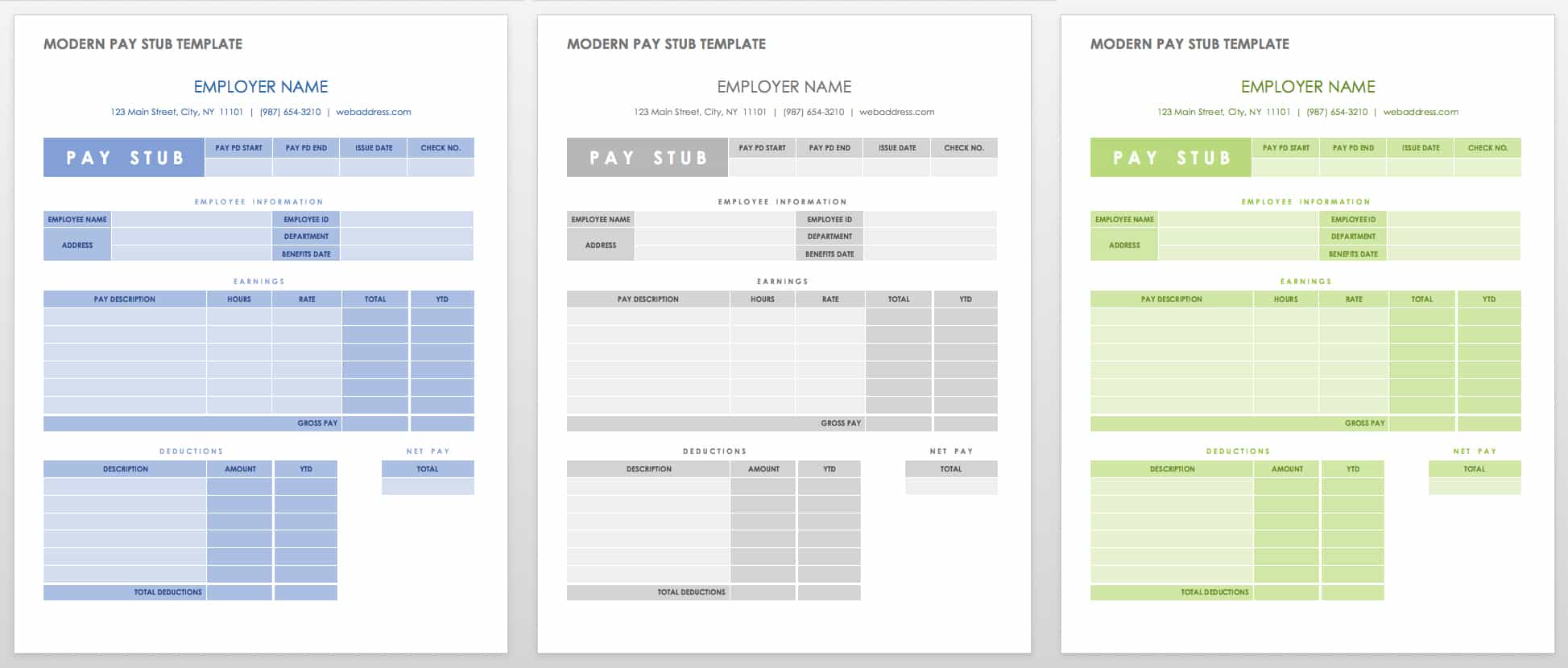

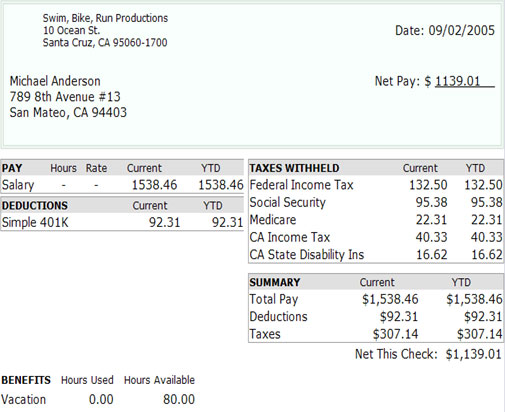

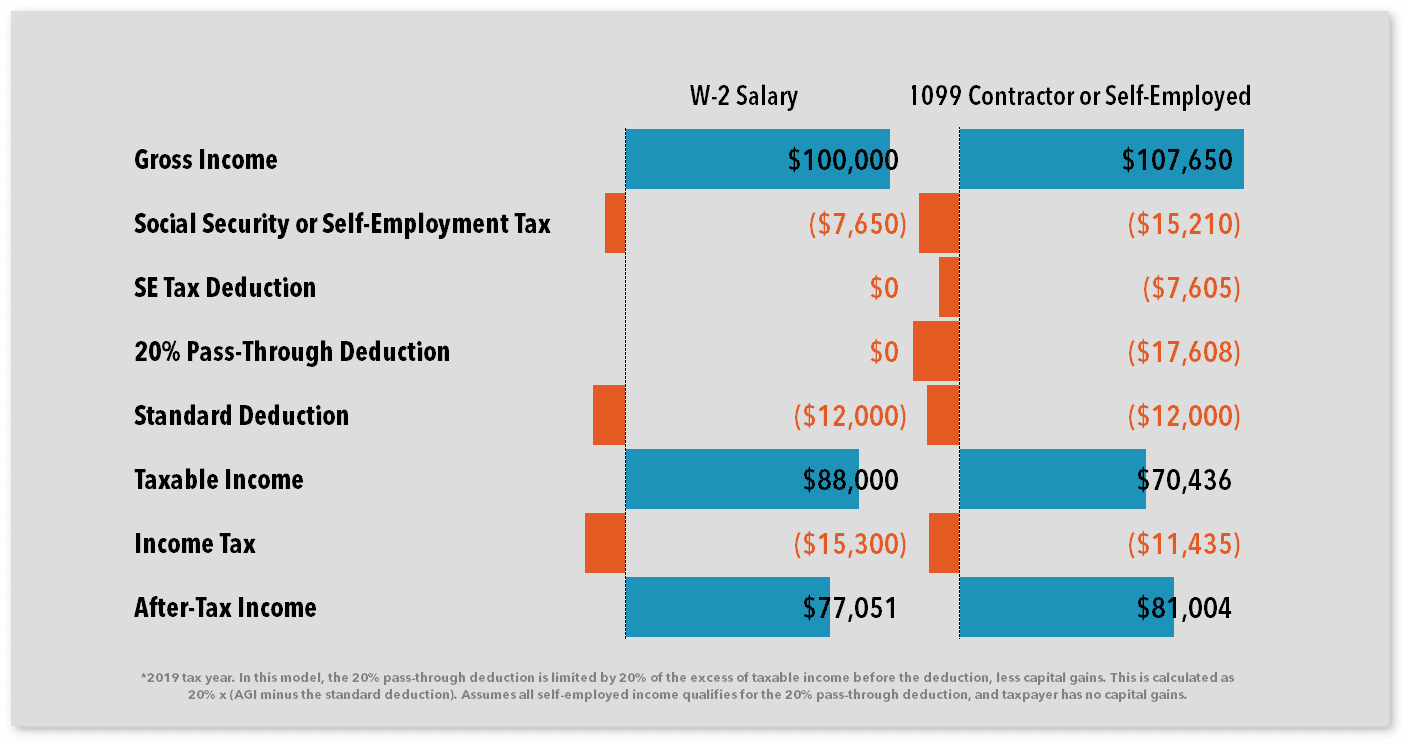

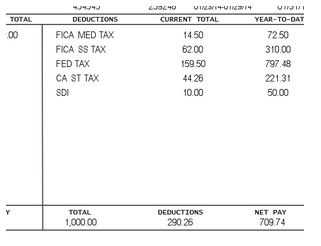

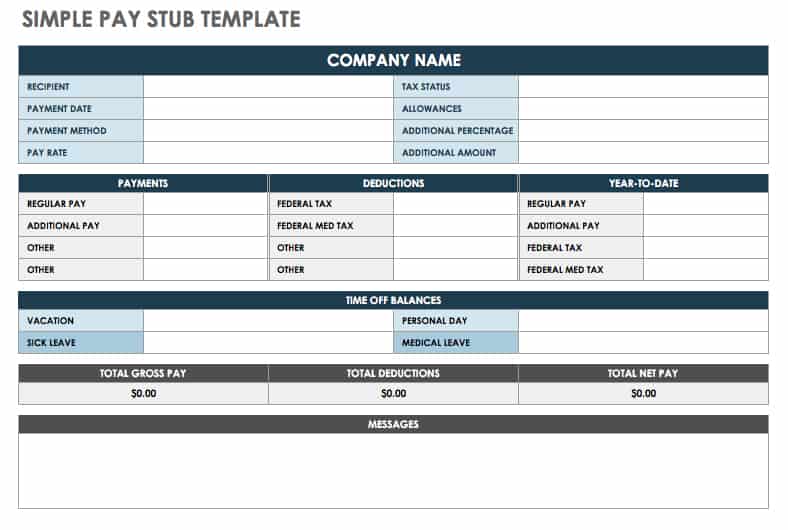

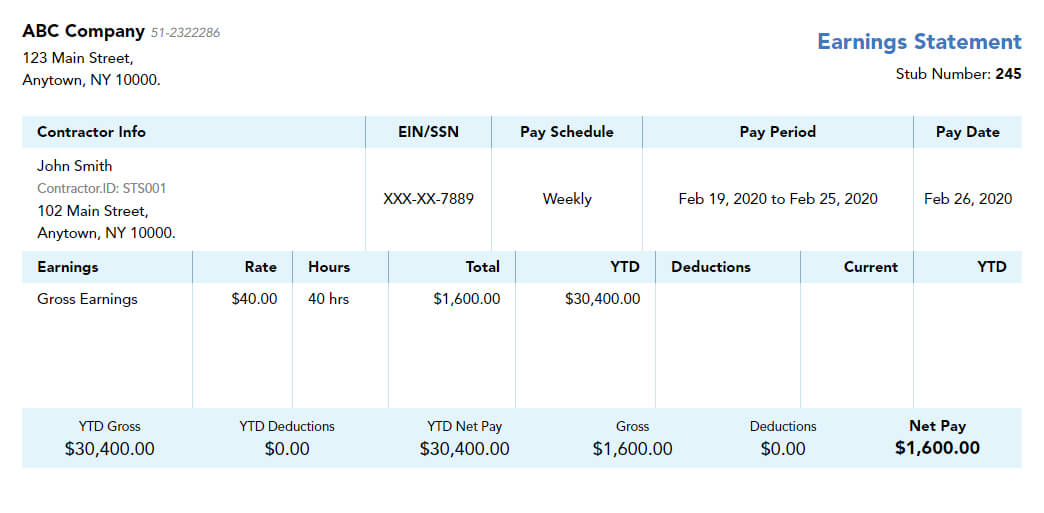

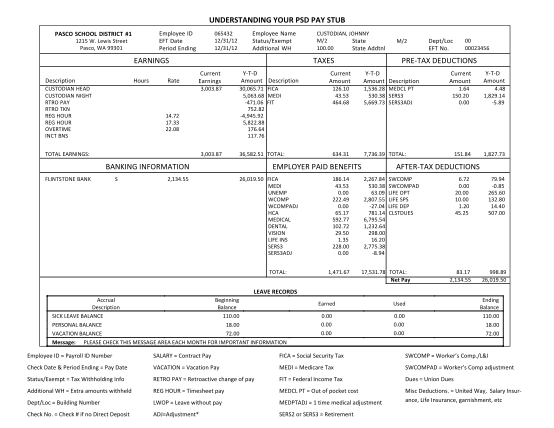

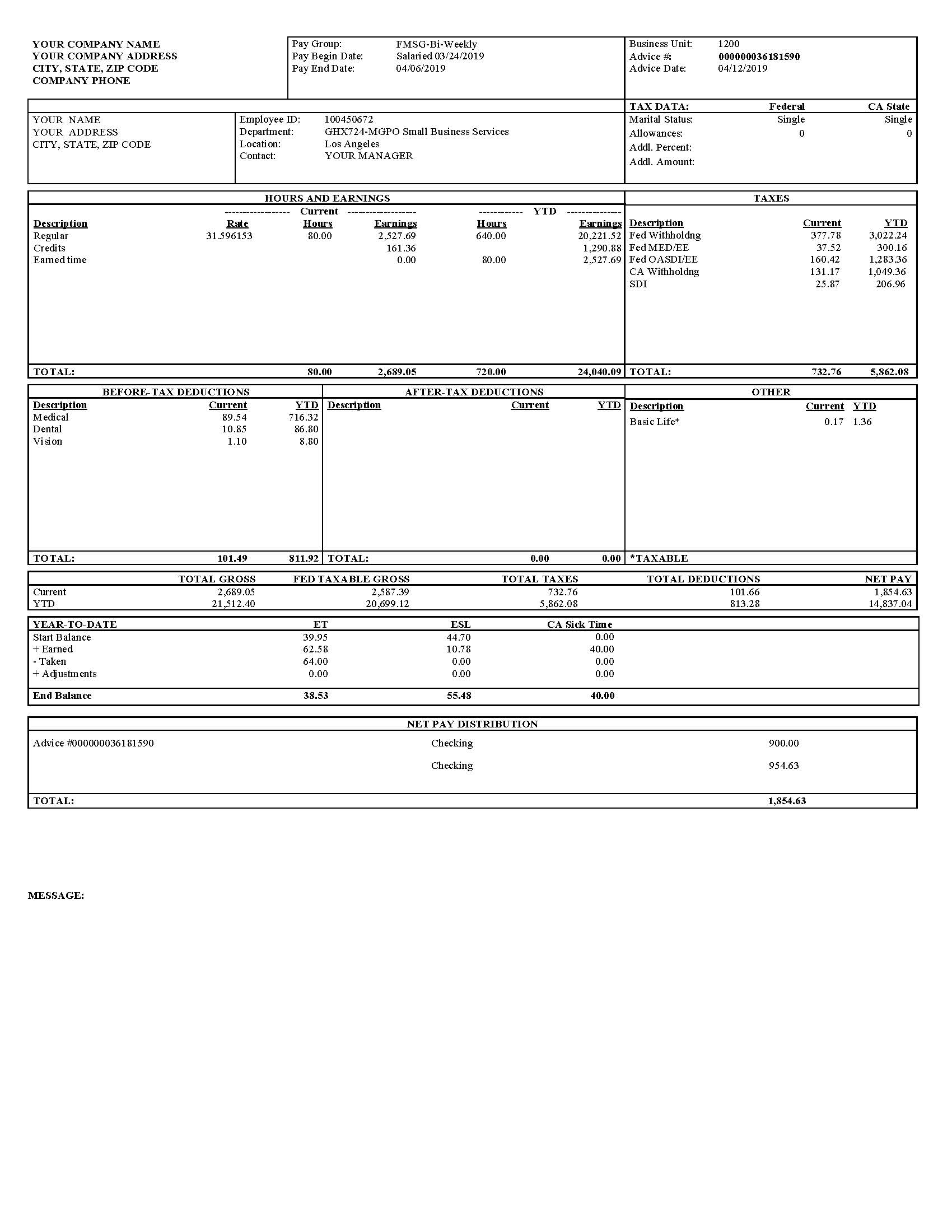

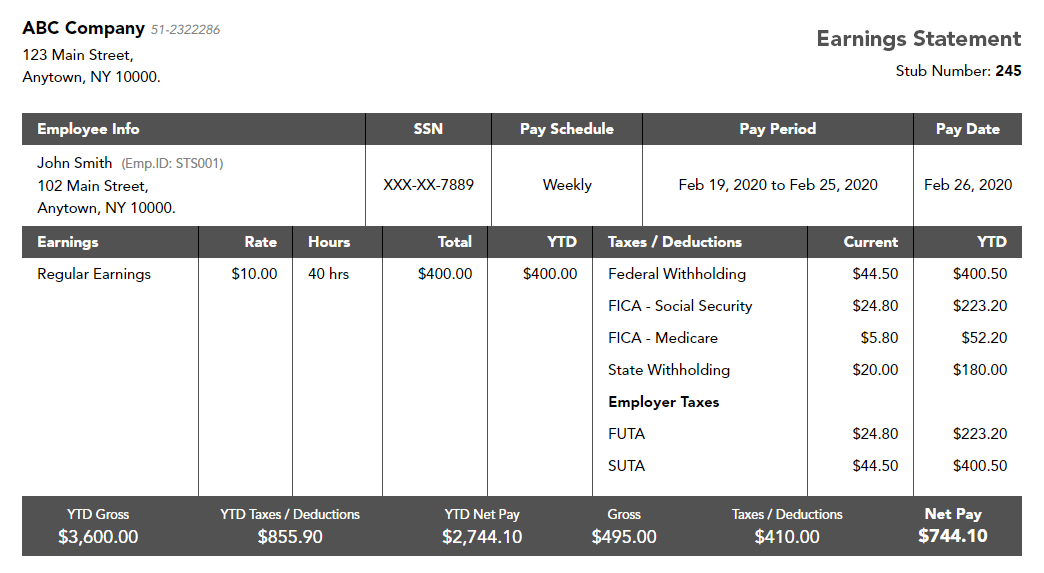

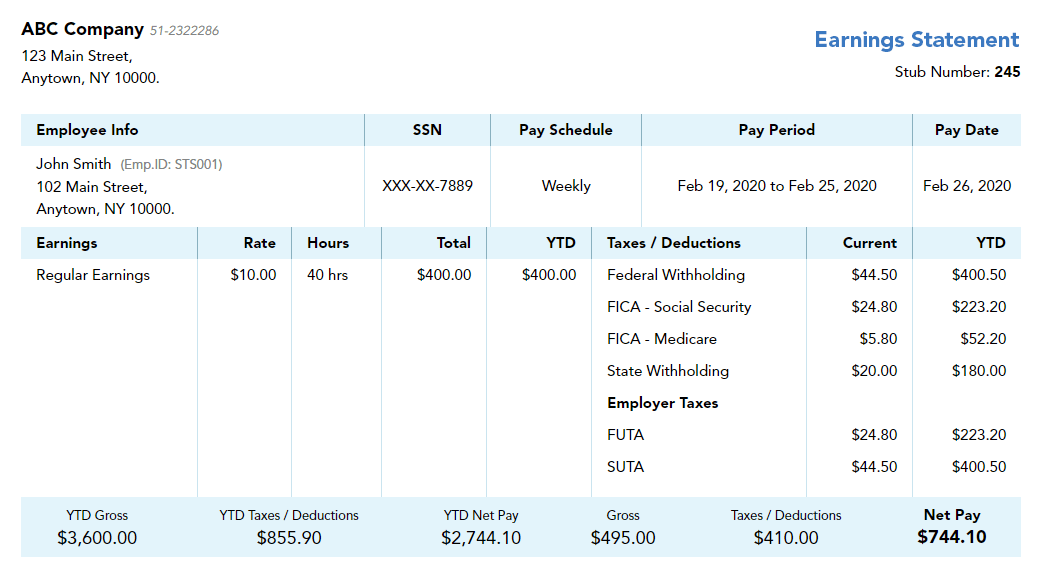

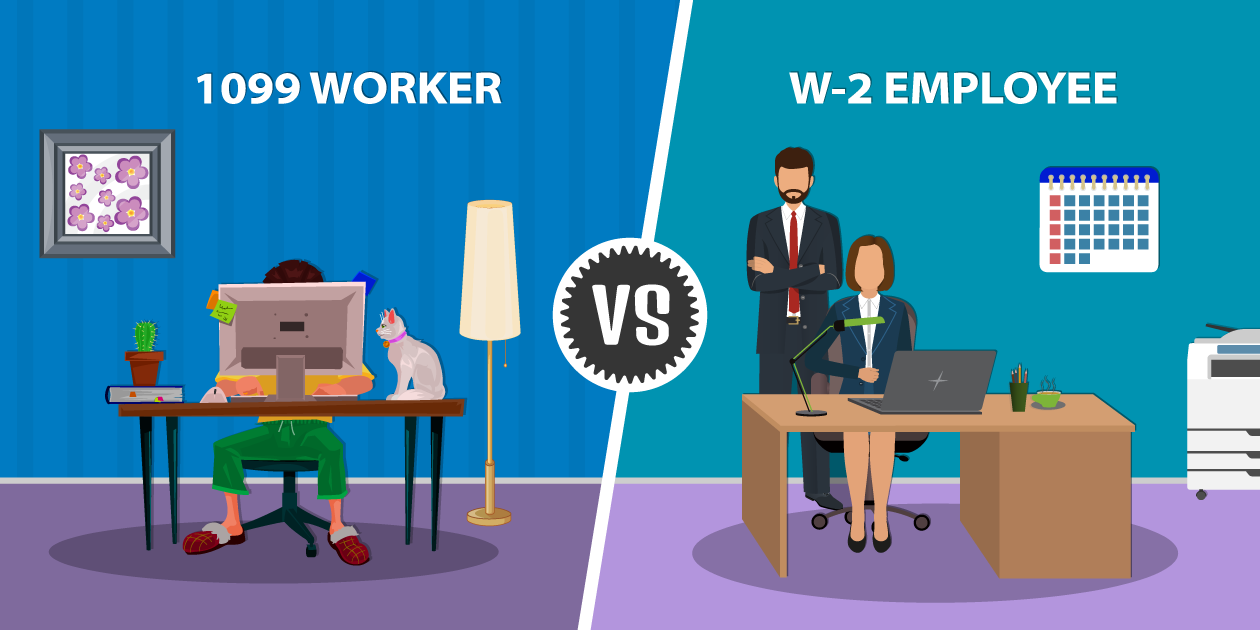

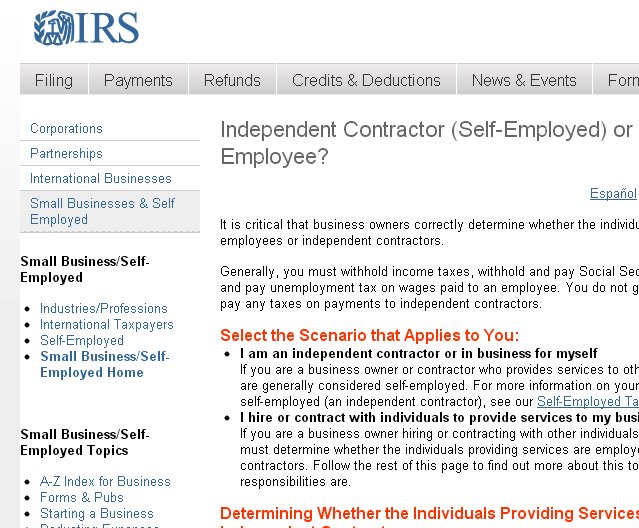

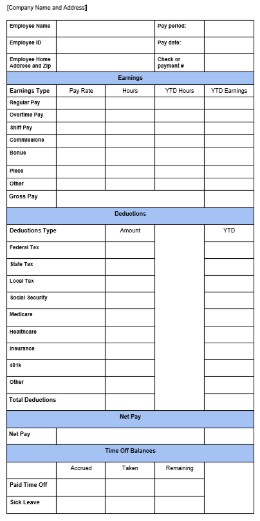

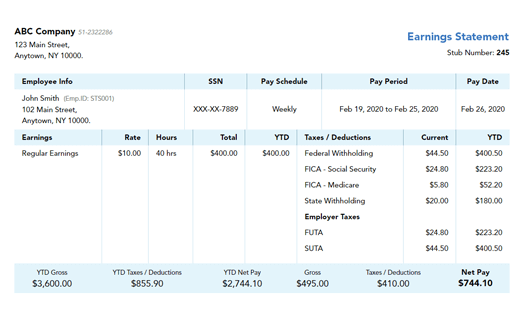

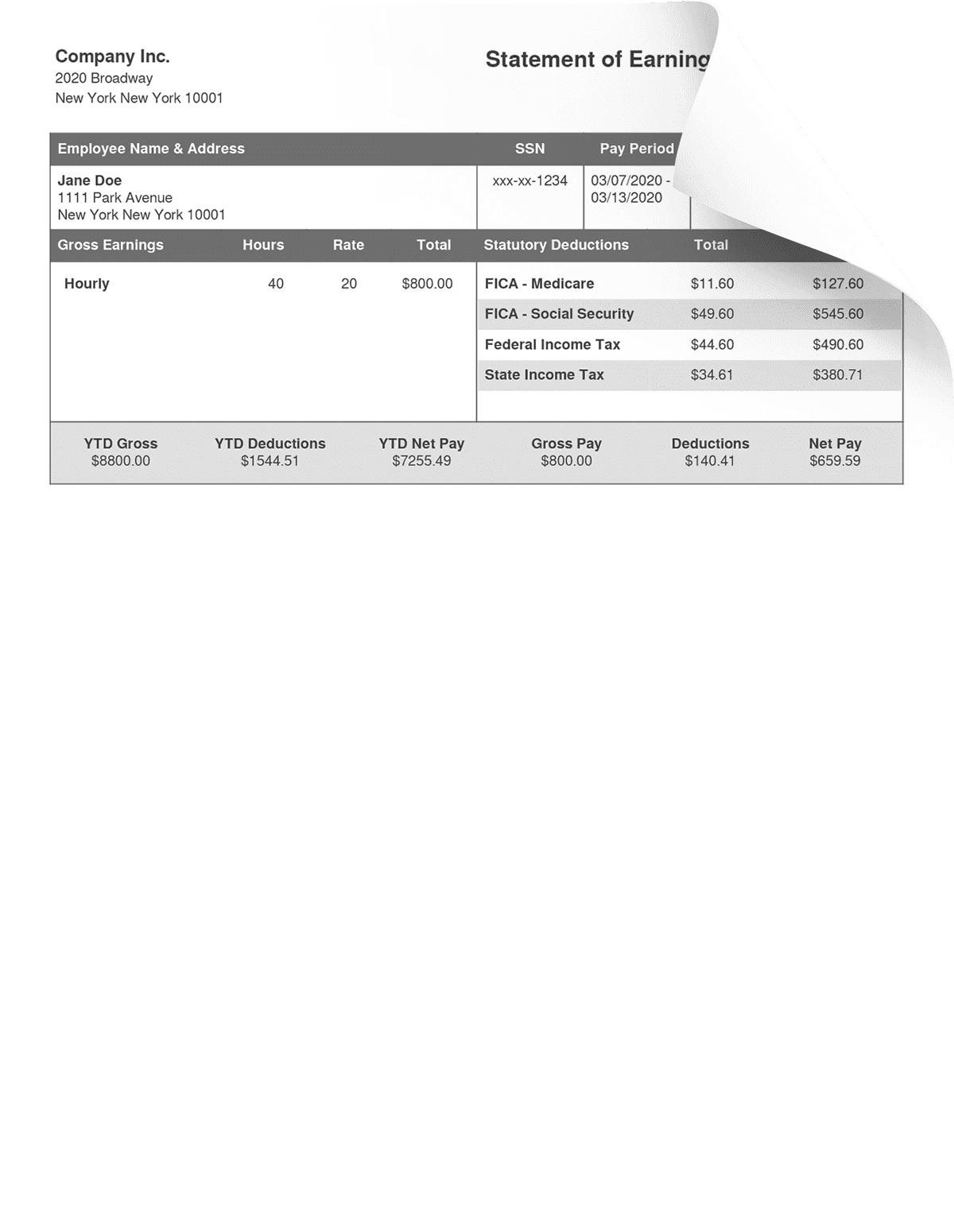

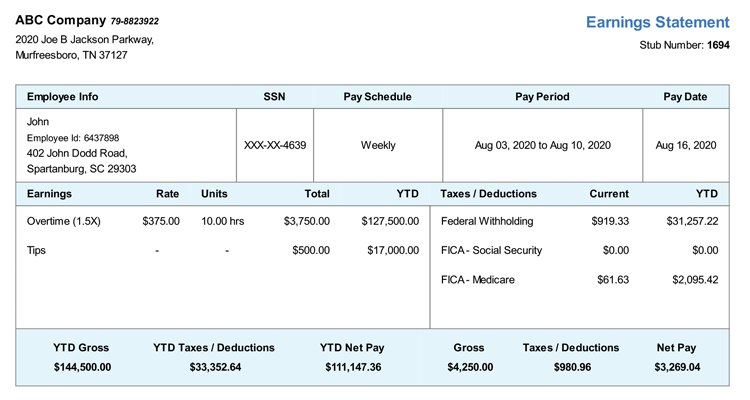

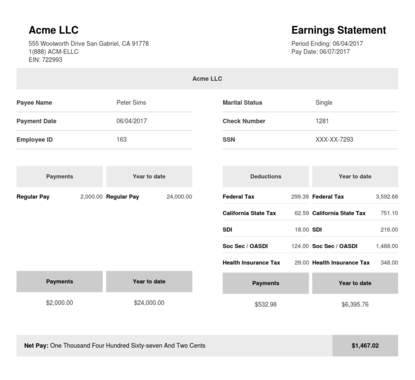

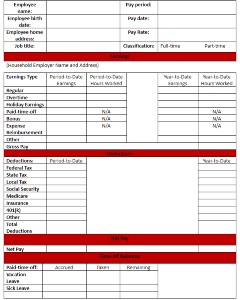

Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats Free Microsoft Excel payroll templates and timesheet templates are the most costeffective means for meeting your back office needs Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting themEasy to use platform for self processing of payrolls Employee self service – to obtain check stubs and W2's Files all required payroll reports and processes payment of tax liabilities Self access for all reports Can facilitate payroll in all 50 states 1099 vendor payment and reporting available Can pay employees with paycards

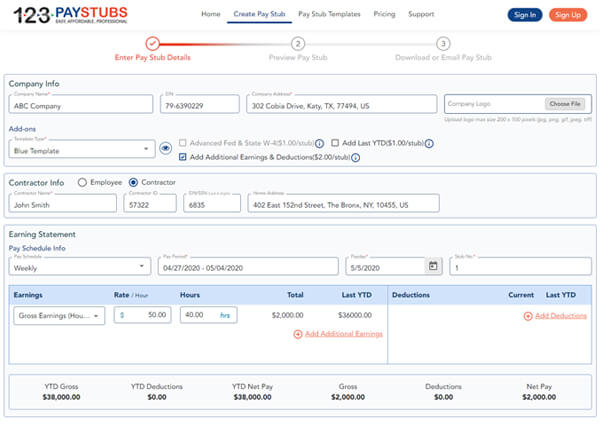

Accepted file types jpg, jpeg, gif, png, Max file size 1 MB, Max files 1 Company Name * Company Address * Street Address City State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland MassachusettsYour deductions for this period are $ 9403 Company Name Company Street Address 1 , Company City, NY Payroll Check Number 7566 Pay Date Employee Name Three Hundred Five And 97/100 Dollars $ Authorized SignatureCreate your own SELF EMPLOYEE instant 1099 employee pay stub in seconds, only require basic information regarding your employment, Now you can generate pay stub with company logo Pay Schedule (How are you paid?) Pay Period YTD Use Pay Period ytd for employees that haven't worked the entire year or to manipulate the employee ytd

Also known as payslips, pay advice or even check stubs Thorugh paycheck stubs, employees get to know whether the payment is made or not, they get to know about their salary as well as their deduction, if made It also acts as a proof that a particular amount of payment is made for the services rendered by the employeesCreate Your Instant Online 1099 Employee Paycheck Stub Please fill in your employment information in the form below, and INSTANTLY generate your own online paycheck stubs Before purchase your stub, you can review and edit your filled pay stub information, after successfully generated pay stub (s), you can download and printA 1099 employee is someone who works in a freelance or "gig" capacity If you know the steps to create check stubs, the process will be a lot quicker Some freelance workers may wish to be paid in a certain way, such as per hour rather than per

Why Use An Online Paystub Generator Form Pros

Sample Pay Stubs Pay Stub Templates Pay Stub

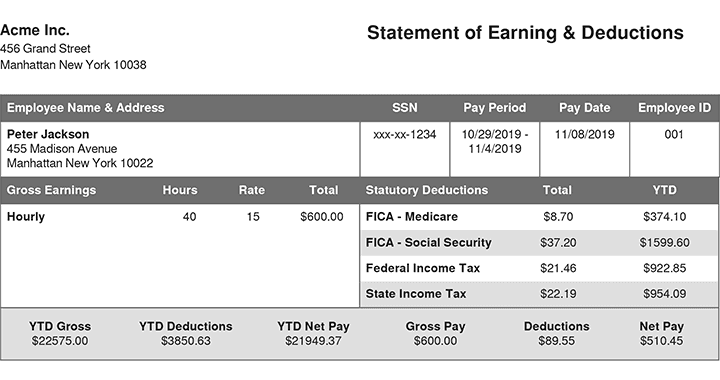

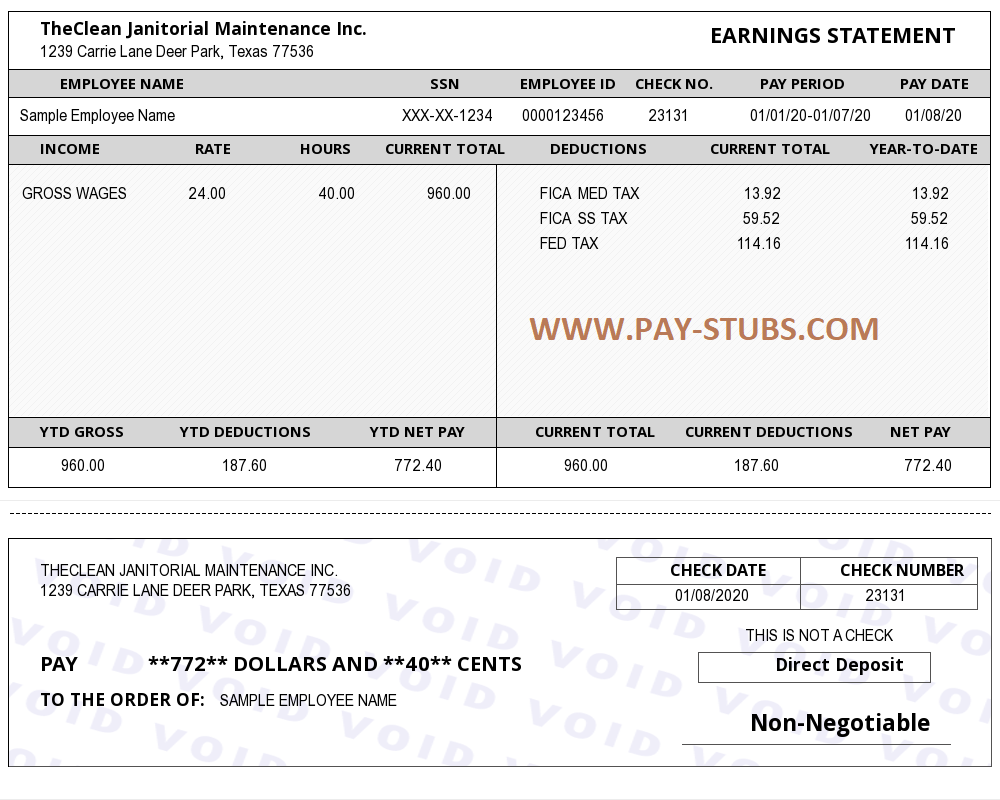

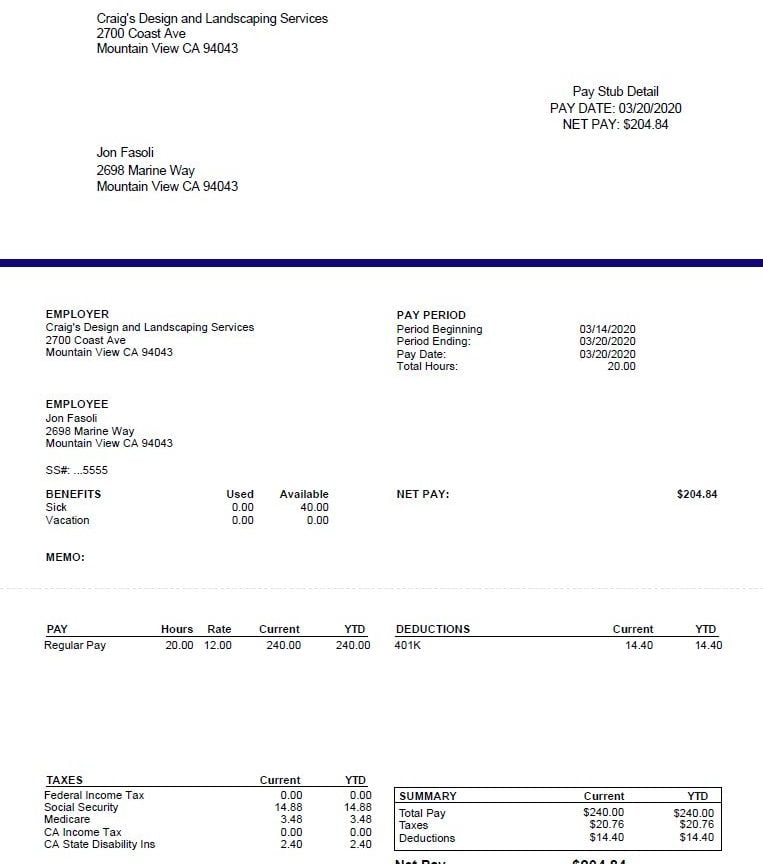

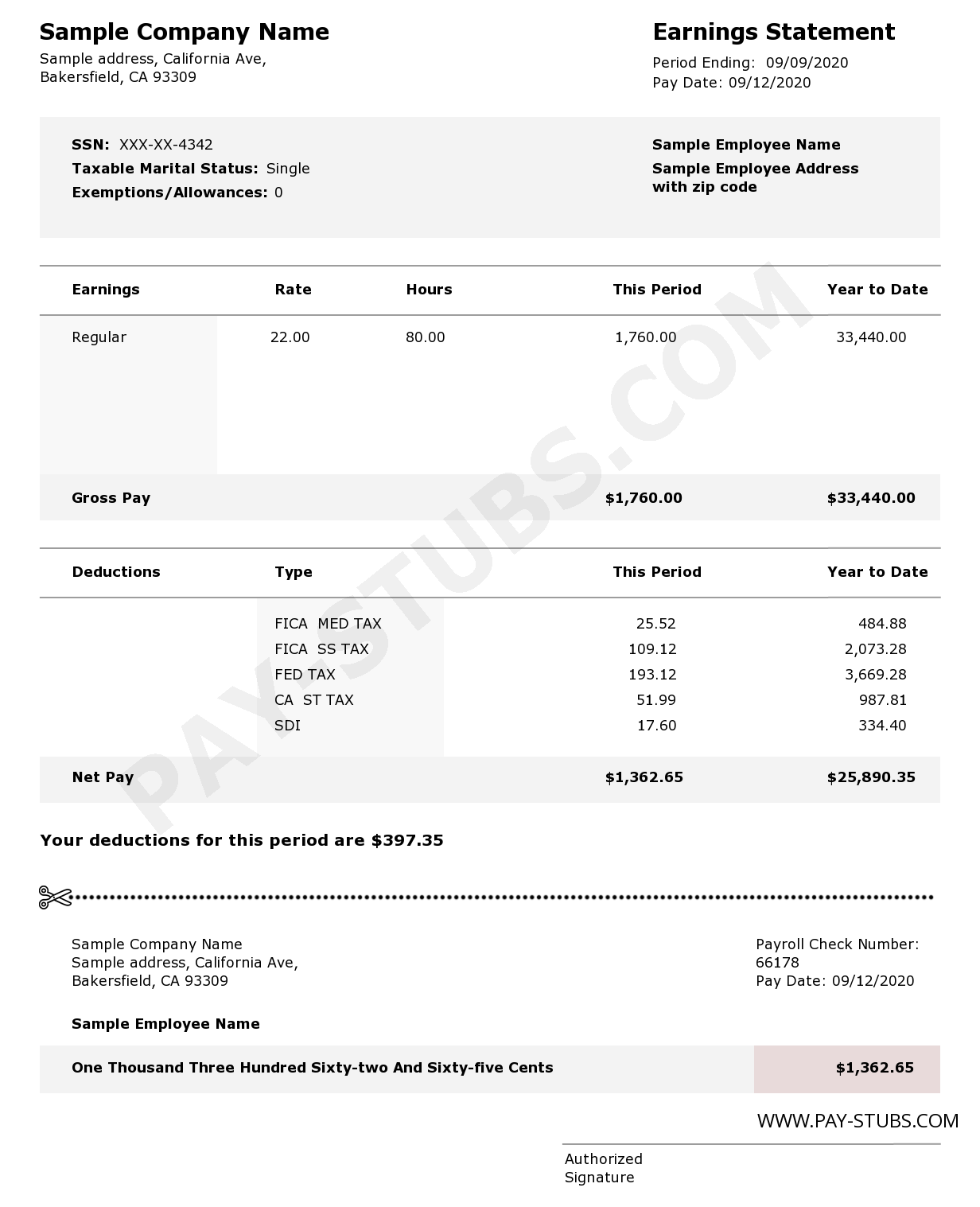

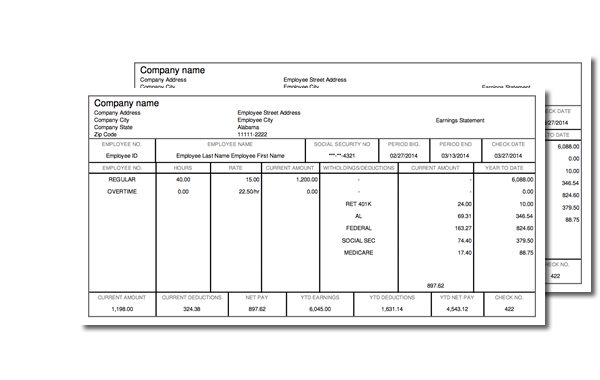

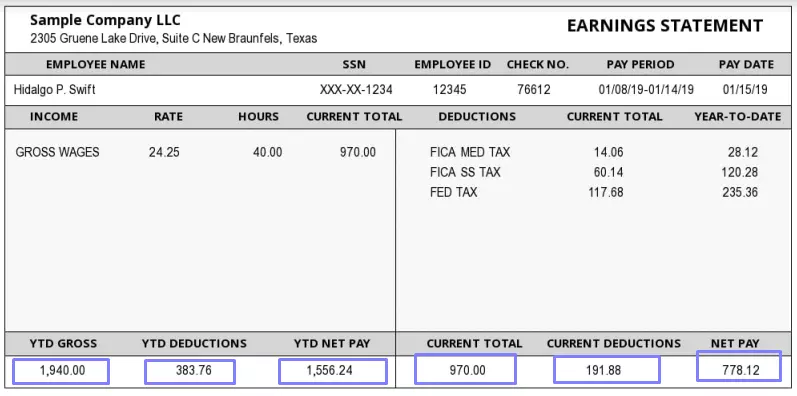

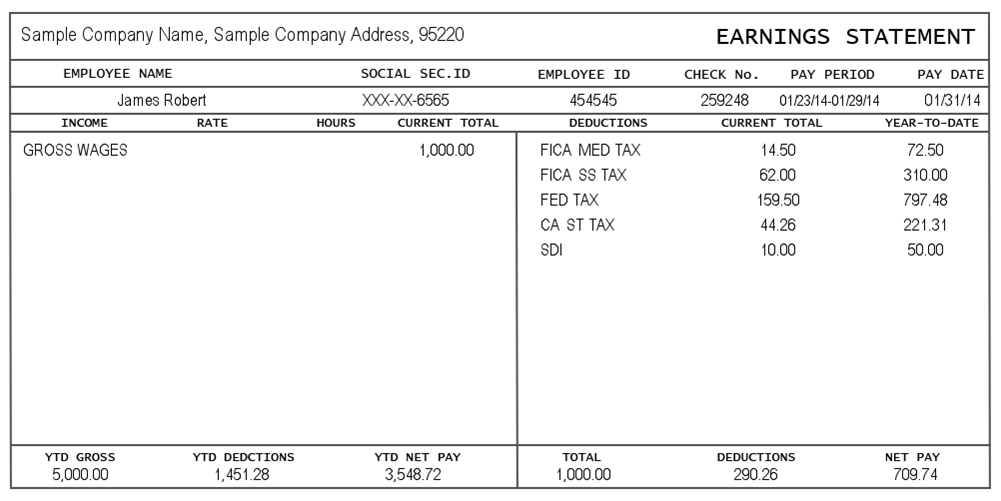

Check stubs, also referred to as pay stubs or payslips are written pay statements that show each employee's paycheck details for each pay period Check stubs itemize how much you are paid and show your total earnings for the pay period, deductions from the Alternative names of a pay stub include payslip, pay advice, check stub, or paycheck, depending on the workplace Employers can opt to draft a companyspecific paycheck stub or use a pay stub template obtained from a paystub generator However, the chosen stub should be uniform among the employees to ensure consistency in record keepingThe most common documentation for proof of income includes Pay stub Bank Statements (personal & business) Copy of last year's federal tax return Wages and tax statement (W2 and/ or 1099) If you cannot provide a copy of one of the common documents listed above, please see below for a full list of approved documents

Free Pay Stub Templates Download Paystub Template Sample Online

Pay Stub Employee Pay Stub Paycheck Stub Maker

Pay Stub Maker is a widely accepted paystub generator tool whether you want to create pay stubs online for employees or contractors This blog will be a read based on the classification of independent contractors and the way in which pay stub generator can assist Besides being useful for independent contractors, Restaurant staffing issues can also be resolved with Paycheck StubsThere's no need to manually send out Form 1099MISC to contractors—they can download it themselves from their online accounts USbased payroll specialists working for you Rest assured knowing our experienced team, along with our smart 1099 software, can help you accurately take care of your payroll These types of workers pay the IRS utilizing the form you sent them, if you feel uncertain as to who to give 1099's to, just remember these non employees are workers that provided labor or services to you, for which you have paid more than $600 in the corse of the year, for these non employees you'll need to send them a 1099 and you have till

Paycheck Stubs Online Archives Pay Stubs Pay Stubs Com

Free Pay Stub Templates Smartsheet

No, you should not print 1099's for employees where you didn't withhold taxes 1099's are not for employees, but are for independent contractors Attempting to cast employees as independent contractors when they are not is noncompliant with the law and you can get in trouble for it Basically, the goverment(s) want their payroll taxes from you W2 vs Form 1099 In a nutshell, employee compensation is tallied on a Form W2 and contractor compensation is calculated on a Form 1099 The W2 also shows how much federal income tax as well as state and local taxes were withheld Form 1099 doesn't show withheld taxes because the contractor is responsible for paying those A 1099 pay stub refers to the 1099MISC form that is used by businesses at the end of each year These forms are sent to contractors that make more than $600 a year from a business Some businesses send these out while others don't Not only that, but they're also sent out once a year What you can do is create your own pay stub using a pay stub template That

Sample Pay Stubs Pay Stub Templates Pay Stub

Independent Contractor Pay Stub Template Luxury 9 Free 1099 Pay Stub Template Powerpoint Timeline Template Free Payroll Template Templates

The 1099MISC form is a form that reports an individual's extra earnings, aside from the salary paid by their employer The employer must generate a 1099MISC form and send it to his employee by January 31st, so that the employee can use it when filling his yearly taxes to the IRS (Internal Revenue Service)Confirm their 1099 Type is correct Enter the amount to pay If you also have Accounting, select the expense account for each contractor Click "Review Payroll" to move to Step 2 In Step 2, you will see summaries for both employee and contractor payrolls Click "View Details" at the top to view each check stub detailOnline salary slip maker Reak Check Stubs with its array of features such as its pay stub template for 1099 employees and employee payroll calculator could give you a huge advantage when it comes to making your job of issuing pay stubs easier They are one of the musthave tools in a business owner's arsenal to give him or her the edge when it comes to dealing with employee

Who Is A 1099 Worker Complete Payroll Solutions Hr Payroll Services Benefits

What Is The Difference Between A W 2 And 1099 Aps Payroll

14 free 1099 pay stub template ninda Paystub Sample No Comments Free 1099 pay stub template "Purchase purchase Finance is readily available for US based companies by having a proven history in their marketplace Purchase purchase funding is some thing that it's likely you have heard people discuss, but you aren'tClick the Documents icon (1) to view or download your check stubs or copies of your Forms W2 / 1099MISC Click Most Recent (2) to retrieve your most recent check stub or Form W2 / 1099MISC From the Category list, click Check Stub, W2, or 1099MISC to access documents for other check dates or years Select the Include (3) checkbox to choose a documentCheckpaystubcom is a reliable & 100% accurate automated paystub generator tool You only have to care that the information entered from your end is correct & the rest will be taken care of by our check stub maker Easy to create, we also share your paystubs instantly via Email for convenience of access

Sample Of Pay Stub Information Instant Pay Stub

Guide To Creating A 1099 Pay Stub Check Stub Maker

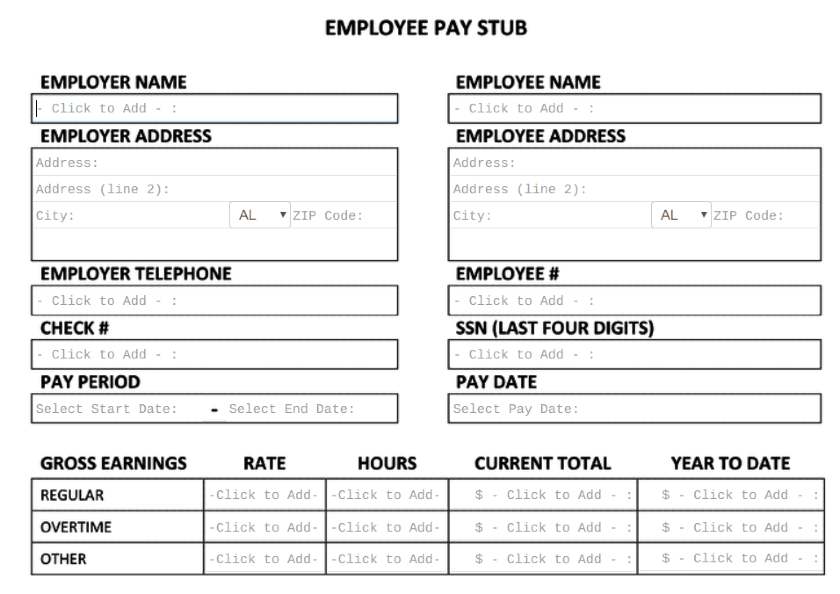

Just follow the simple steps to generate pay stubs for 1099 independent contractors Enter a few basic information and choose the pay stub template Then preview or make corrections and download the paystub easily in less than 2 minutes Enter the company information such as Name, Address, and EIN The law around paystubs is really murky at best Federal law has nothing stating that employers are required to provide pay stubs to their employees and independent contractors They are required to provide end of year forms like a W2 form and a 1099MISC if employees and contractors are paid more than $600 during the year While a 1099 pay stub is not required, it is still a good way to help you keep track of where your money is going Most accountants would recommend that you use them either for your independent contractors or for yourself Create your pay stub

Paycheck Stubs Online Small Business Pay Stub Speedy Stub

Free Pay Stub Templates Smartsheet

Multiple 1099R forms are required if you receive more than one "type" of distribution as defined by the IRS regulations or if you receive payments for more than one "Payee Type" (ie Retiree, DROP, Beneficiary, Survivor, Alternate Payee) The IRS 1099R Distribution codes (from Box 7 of the 1099R form) are explained belowPrints payroll checks and check stubs Payroll Software Direct Deposit option (creates ACH files) Pay nonemployees (1099 Contractors) and print 1099 forms Vendor and 1099 Center Details Option to print MICR checks (print on blank check stock) Payroll Software for accountants, payroll service bureau and small businesses The Greatest Paystub Template to 1099 Employee Trick The department that is earning must list It's likely to greatly benefit from the printable test stubs since it doesn't prevent you from having the capability to create a printout even if you harbor 't enrolled to a free account on paycheckcitycom

Independent Contractor Paystub 1099 Pay Stub For Contractors

What Information Do You Need Before Creating A Paystub Form Pros

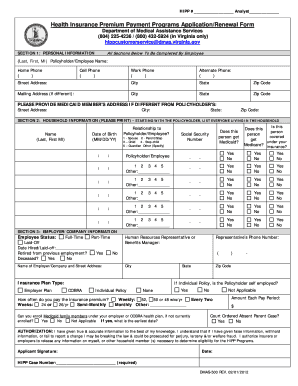

Proof of income, which can include 1099 tax forms, 1099 pay stubs, Form 1040 tax returns and tax returns Bank account number and routing number for direct deposit of benefits Keep in mind that each state will have specific requirements, so do your research and collect all relevant documents before starting the unemployment application processWhat is a 1099 Form?Make check stubs online with Stub Builder as we help you with the best calculator for inhand salary calculations on hourly, weekly, monthly, quarterly or yearly basis Payday will feel like a breeze with this real check stubs calculator tool and you can easily make check stubs for your permanent employees, independent contractors or freelancers

What Is A 1099 Contractor With Pictures

Nick Nick Nickinick2 Profile Pinterest

Free Paycheck Stub Template Free Pay Stub Templates are available with Stub Creator which is ready to download and use Free check stub templates give you a clear idea of the exact format you will receive in generated pay stub As you get the freedom to choose the template of your choice, you can choose the format in which your employees will receive the stub A pay stub can help the contractor verify that the dollar amount on the 1099 is correct If Acme Manufacturing pays you $5,000 for contracting work in , that dollar amount should be listed on the 1099, and on the yearend pay stub If the amounts don't agree, contract the client to resolve the problem In addition, you need to check if regional motels have complimentary rooms and therefore so are of the precise same selling cost and quality, which means that you may send your visitors sample pay stub for 1099 employeepaystubtemplatefor1099employeebusinesstemplatesfreeprintablepayrollandpaystubtemplatesample1024×427jpg

Independent Contractor Paystub 1099 Pay Stub For Contractors

How Do I Print A Vendors Direct Deposit Pay Stub

Fill in the required company, employee, earnings, and pay schedule information Choose the template you prefer, preview paystub, and make corrections if required Download and print paystub instantly or email it directly to your employee or contractor Generate pay stubs with accurate tax calculations With a 1099 pay stub, you can start taking out loans and efficiently keep records of how much you earn Whether you use a generator or a program like Google Spreadsheets, paycheck proof with a pay

Pay Stub Generator Free Printable Pay Stub Template Formswift

How To Make A Pay Stub As An Employer Or A Contractor Youtube

Fha Loan With 1099 Income Fha Lenders

Payroll Services

How To Print Payroll Checks An Employer S Step By Step Guide Gusto

Is There An Independent Contractor Pay Stub

12 Best Apps To Pay 1099 Independent Contractors And Freelancers Bean Ninjas

10 Pay Stub Template For 1099 Employee Simple Salary Slip Statement Template Payroll Template Payroll Checks

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software

5 Best Payroll Software Solutions For Contractors

Paycheck Stubs Online Small Business Pay Stub Speedy Stub

1099 Vs W2 Difference Between Independent Contractors Employees

Pay Stub Generator Free Printable Pay Stub Template Formswift

Paystub Generator For Self Employed Fill Online Printable Fillable Blank Pdffiller

Free Pay Stub Templates Smartsheet

Free Printable Independent Contractor Pay Stub Template Wallpaper Database

Sample Pay Stubs Pay Stub Templates Pay Stub

Independent Contractor Paystub 1099 Pay Stub For Contractors

Independent Contractor Paystub 1099 Pay Stub For Contractors

18 Pay Stub Template Free To Edit Download Print Cocodoc

How To Print Pay Stubs In Quickbooks Online Nerdwallet

Www Kids Care Com Wp Content Uploads Sites 3693 16 12 5 Eao Managing Ee Access Pdf

Independent Contractor Pay Stub Everything You Need To Know Uncustomary

Paystub Generator For Self Employed Fill Online Printable Fillable Blank Pdffiller

Sample Pay Stubs Pay Stub Templates Pay Stub

1099 Pay Stub Template Excel New Pay Stub 1099 Letter Examples Generator For Worker Maker Templates Words Excel Templates

Complaint For Permanent Injunction And Other Equitable Relief

Pick The Right Free Paycheck Stub Template Stub Creator

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Should Independent Contractors Receive A Pay Stub

Independent Contractor Pay Stub Template Fill Out Pdf Forms Online

21 Printable Pay Stub Template Free Forms Fillable Samples In Pdf Word To Download Pdffiller

Paycheck Stubs Online Small Business Pay Stub Speedy Stub

Print Payroll Check Stub Shefalitayal

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

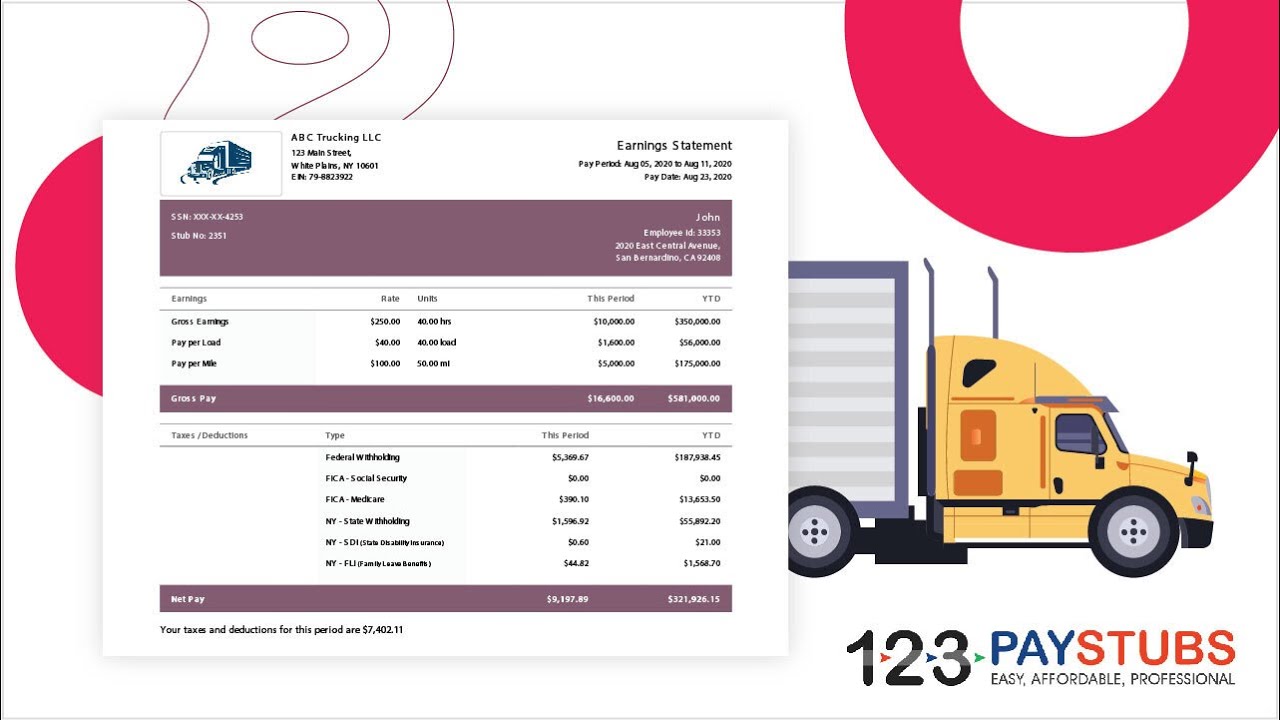

How To Generate Pay Stubs For Truck Drivers And Dispatchers 123paystubs Youtube

Online Paystub Generator Online Payroll Maker Free Pay Stub Pay Check Stub Creator Create Professional Pay Stubs Paystubsnow Com

How To Make And Print Paycheck Stubs With Ezpaycheck Software

1099 Contract Employee Agreement

Independent Contractor Paystub 1099 Pay Stub For Contractors

Fillable Pay Stub Pdf Fill Online Printable Fillable Blank Pdffiller

Free Pay Stub Templates Download Paystub Template Sample Online

I1 Wp Com Www Iowa Media Wp Content Uploads 2

Free Pay Stub Templates Sample Paystubs Online 123paystubs

Free Paystub Generator For Self Employed Individuals

1099 Workers Vs W 2 Employees In California A Legal Guide 21

Adp Paystub Sample Template Blue Thepaystubs Com

What Is A Pay Stub Examples And Explanation Fairygodboss

15 Printable Independent Contractor Pay Stub Template Forms Fillable Samples In Pdf Word To Download Pdffiller

Pay Stub Employee Pay Stub Paycheck Stub Maker

How To Provide Paycheck Proof When You Re Self Employed Az Big Media

3

1

Free Online Pay Stub Generator Free Check Stub Maker Stubcheck

Can The Same Person Be An Employee And An Independent Contractor

Is There An Independent Contractor Pay Stub

1

How Do I Print A Vendors Direct Deposit Pay Stub

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Free Pay Stub Template Tips Laws On What To Include

Free Paystub Creator Create Pay Stubs Online Expressextension

Independent Contractor Paystub 1099 Pay Stub For Contractors

1

Print Pay Stubs In Quickbooks Desktop

Free Check Stub Maker With Calculator Easy Paystub Maker Online In Usa

Free Check Stub Template Printables Free Download Payroll Checks Payroll Template Letter Template Word

How To Make A 1099 Pay Stub For The Self Employed The Daily Iowan

Online Paystub Generator Online Payroll Maker Free Pay Stub Pay Check Stub Creator Create Professional Pay Stubs Paystubsnow Com

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Free Online Paystub Generator Generate Pay Stubs Instantly

Paystub Sample Templates Thepaystubs Com

Pin On Payroll Template

The Difference Between A W2 Employee And A 1099 Employee Ips Payroll

Online Paystub Generator Online Payroll Maker Free Pay Stub Pay Check Stub Creator Create Professional Pay Stubs Paystubsnow Com

How Do I Print A Vendors Direct Deposit Pay Stub

How Do I Print A Vendors Direct Deposit Pay Stub

Build A Check Stub

Pay Stub Generator Free Printable Pay Stub Template Formswift

Check Stub Template Printables Pdf Forms Online Try Pdfsimpli

How Can I Hide Social Security Numbers On Payroll Check Stubs

5 Best Payroll Software Solutions For Contractors

Free Pay Stub Template Tips Laws On What To Include

Pay Stub Generator Free Printable Pay Stub Template Formswift

Free Pay Stub Template Tips Laws On What To Include

0 件のコメント:

コメントを投稿